The Indian convenience food market is valued at ₹79 billion in FY24 and is set for robust expansion, projected to reach ₹166 billion by FY 2029, reflecting an impressive CAGR of 16%. This strong growth is primarily driven by evolving consumer lifestyles, rapid urbanization, increased participation of women in the workforce, and a high demand for time-saving meal solutions, leading to continuous innovation and premiumization within the sector, including the introduction of healthier alternatives.

The market is segmented into Ready-to-Eat/Ready-to-Cook and Frozen Foods. While RTE/RTC is expected to grow at a CAGR of 12.3%, the Frozen Foods segment is leading the charge with a projected CAGR of 18.1% due to improvements in cold-chain infrastructure and rising demand for longer shelf-life products, particularly among young working professionals. As of Fiscal 2024, the RTE/RTC category sees its key players holding a 41.7% market share.

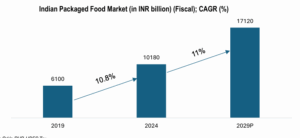

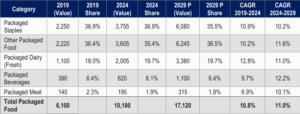

The Indian packaged food industry is experiencing robust growth, driven by evolving consumer preferences and structural shifts in the market. As of FY 2024, the industry was valued at ₹10,180 billion and is projected to reach ₹17,120 billion by FY 2029, reflecting a compound annual growth rate (CAGR) of 11%. This expansion is fueled by increasing demand for branded products, convenience-oriented food options, and health-conscious alternatives. The rise of modern retail formats and online platforms has further accelerated accessibility and consumer experimentation with regional and global flavors.

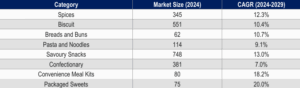

India holds a dominant position in the global spice market, contributing approximately 70% of global spice production by volume and 43% of global spice exports by value. The domestic spice market alone was valued at ₹345 billion in FY 2024 and is expected to grow to ₹615 billion by FY 2029, with a CAGR of 12.3%. This growth is supported by the country’s rich culinary heritage and the increasing preference for authentic, high-quality spice blends.

Source: Orkla RHP, HDFC Tru

Source: Orkla RHP, HDFC Tru

Convenience foods, including ready-to-cook (RTC) and ready-to-eat (RTE) products, are gaining traction due to urbanization, the rise of nuclear families, and a growing working population seeking time-saving meal solutions. Consumers are also showing a strong inclination toward clean-label, organic, and sustainable food products, reflecting heightened awareness of food safety and quality.

The competitive landscape remains fragmented, with strong regional players and increasing consolidation through mergers and acquisitions. Innovation in product formats, packaging, and shelf-life enhancement is becoming a key differentiator. Overall, the industry is poised for sustained growth, supported by favourable demographics, rising disposable incomes, and a shift in consumption patterns toward convenience and quality.

Source: Orkla RHP, HDFC Tru

1. Hygiene and Purity Concerns: Consumers prefer packaged spices over loose ones due to safety, quality consistency, and certifications that ensure purity and build trust.

2. Convenience: Urban lifestyles and time constraints drive demand for blended/pre-mixed spices like Sambar Masala, Chicken Masala, and Biryani Masala for quick cooking.

3. Diminishing Cooking Skills & Authentic Taste: Millennials and Gen Z lack traditional cooking skills but seek authentic flavors, making ready-to-use spice mixes popular.