India’s CPI and GDP series are set for a critical refresh, adopting new base years of 2024 and 2022-23, respectively. Modernized baskets & methodologies better capture services growth, GST formalization, and digital shifts long missing from old data. Expect refined inflation dynamics aiding RBI targeting, alongside sharper growth insights for fiscal planning.

This note prepares you to navigate the critical transition.

Introduction

India’s statistical system is being modernized to mirror a rapidly evolving economy. Since the 2011-12 base year, services have surged, GST has boosted formalization, and digital platforms have reshaped business – necessitating timely, granular data on informal/services sectors for credible policy inputs.

India’s CPI inflation and GDP series are undergoing base year revisions to reflect current economic structures. New CPI data (base 2024) will be released on February 12, 2026, and GDP (base 2022-23) on February 27, 2026. These updates will recalibrate inflation readings and growth figures, impacting RBI policy and bond yields for fixed income investors.

What’s changing?

Current base year for both CPI and GDP is 2011-12

Why Rebasing?

Source: PIB, MoSPI, HDFC Tru

PFMS – Public Financial Management System; HCES – Household Consumption Expenditure Survey

Base Year Revision in Compilation of GDP Series

- Base year will be changed from 2011-12 to 2022-23.

- Since 2011-12, India’s economy has transformed drastically, with new industries emerging (e.g., renewable energy, digital services) and changes in consumption pattern and investment behaviour.

- Increased digitization has opened new data sources and incorporating these will improve accuracy and details of national accounts.

- Why 2022-23?

- It is the most recent normal year after the Covid-19 pandemic, which temporarily altered consumption patterns and industrial output.

- GDP will continue to be compiled using the expenditure and production/ income approaches. Methodological refinements will be introduced to improve data accuracy.

- The new series of GDP (base year 2022-23) will be released on 27 February 2026.

Revision of the Consumer Price Index (CPI) Base Year

- CPI series revision will use the data from the Household Consumption Expenditure Survey (HCES) 2023-24. It will revise the item basket and expenditure weights to reflect the current expenditure patterns in both rural and urban India.

- The revision is intended to improve the accuracy and relevance of CPI estimates, strengthen methodological transparency, and support better-informed economic policymaking.

- The new series of CPI (base year 2024) to be released on 12 February 2026.

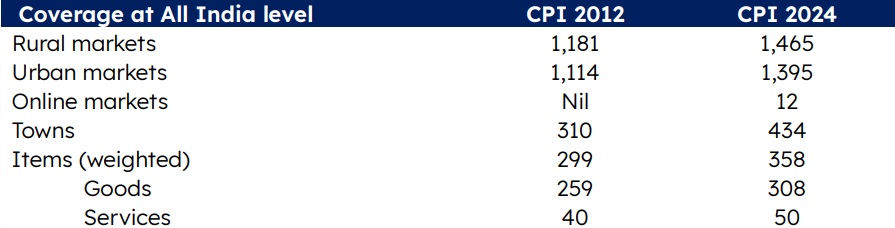

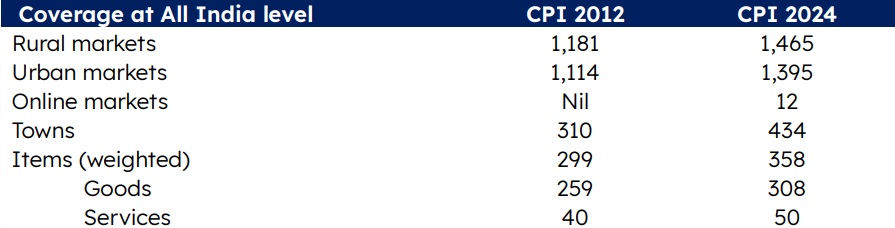

Comparison of CPI coverage of markets and items

Source: MoSPI, HDFC Tru

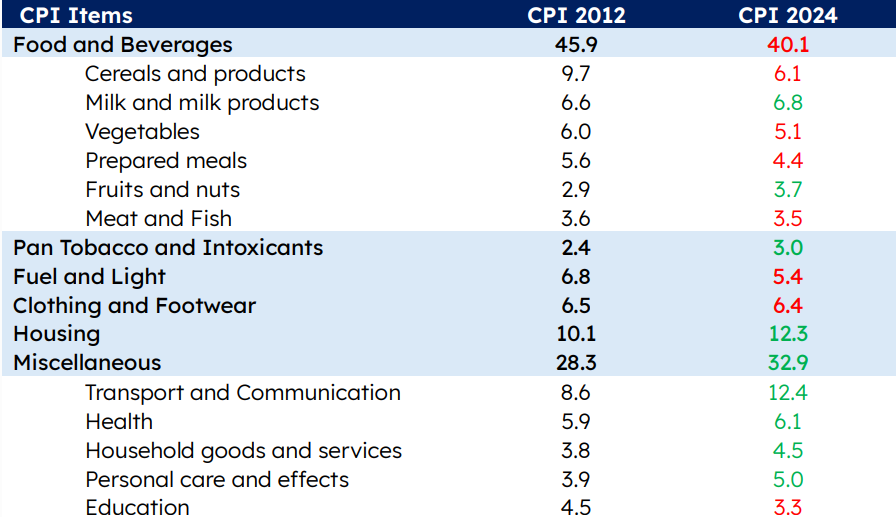

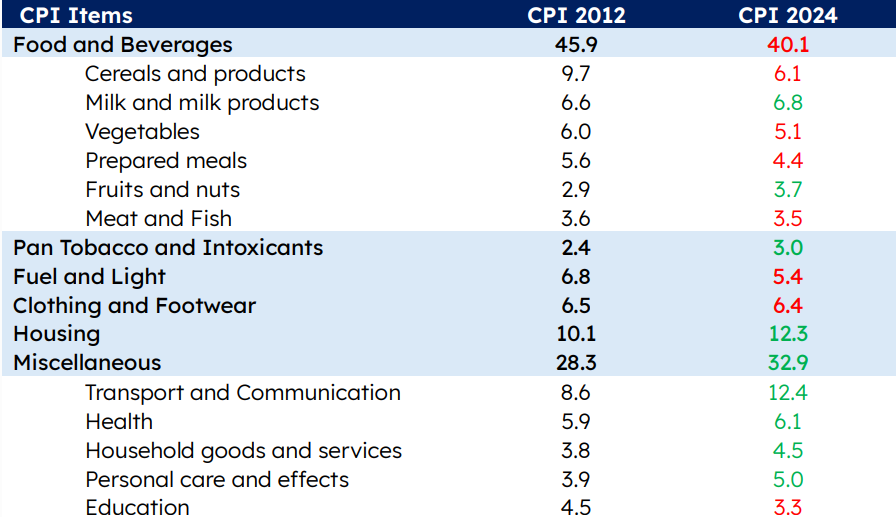

CPI inflation Weights: New vs. Old Series

Source: MoSPI, HDFC Tru; Note – Certain items have been reclassified for better comparison, red font in CPI 2024 column denotes decrease in weight while green font reflects increase in weight. Only key items are shown under Food and Beverage and Miscellaneous categories.

Key changes in the CPI items and their weights are highlighted below:

- In the new CPI 2024 series, share of food and beverages is expected to come down to 1% from 45.9% in the old (2012) series.

- In the new series, free of cost items such as food grains under PDS will not be included for the compilation of CPI.

- The share of core CPI inflation (defined as Headline excluding food & beverage, fuel & light and pan and tobacco) is estimated at 6% in new series versus 44.9% in the old series.

- The weightage of rural index (4% vs. 53.5% earlier) has increased while that for urban (44.6% vs. 46.5%) has come down in the new series (likely due to inclusion of housing index for rural areas).

- Share of housing has increased to 3% compared to 10.1% in the old series. The new series will also include ‘house rent’ in the rural sector which was not covered earlier.

- In view of the changing consumption pattern, the new series will also capture price movements on the e-commerce platforms with 12 online markets added to capture price movements.

- The share of gold in the overall CPI basket is expected to come down to 62% vs 1.08% in the old series. On the other hand, the share of silver is estimated to increase to 0.31% from the earlier 0.11%.

Likely impact on CPI inflation readings

- As per market estimates, based on the new items and weights, FY26 CPI inflation could see a 50-bps increase compared to the old series.

- The pick-up is likely to be on account of lower weights for food and beverages in the new series.

- Due to the new CPI basket and weights, RBI’s February 2026 MPC deferred full-year FY27 GDP and CPI forecasts for data stabilization.

![]()

![]()