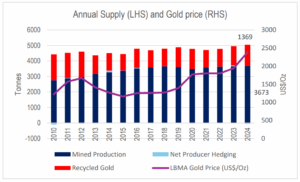

Annually, around 3,600 tons of gold is mined globally, around 1,200 tons of gold is recycled.

(Source: https://www.gold.org/goldhub/data/gold-demand-by-country; https://www.cnbc.com/2024/06/10/gold-miners-struggle-with-excavating-more-says-world-gold-council.html)

China is the largest country producing gold in the world, accounting for around 10% of total CY23 gold production. Africa produces around 28%, whereas Asia produces 18% of total newly mined gold. Central and South America produce around 15%, North America produces around 13%, and Australia and Russia produce around 8% of the total newly mined gold. (Source: Shanti Gold DRHP).

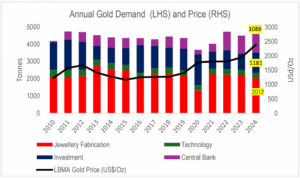

Overall gold demand inched up marginally from 4,365 tonnes in 2019 to 4,605 tonnes in 2024.

(Source: https://www.gold.org/goldhub/data/gold-demand-by-country )

Central banks were net sellers of gold from 2002 to 2008 and have been net buyers since 2008. Over the last three years, central banks have ramped up gold buying significantly with net purchase of more than 1,000 tonnes in each of the last three calendar years.

Over the last three years, Central banks of China, India and Poland have been among the largest buyers of gold. The aggregate net purchases over the last three years by China, India and Poland have aggregated 331.2 tonnes, 122.1 tonnes and 217.4 tonnes respectively. (Source: https://www.gold.org/goldhub/data/gold-demand-by-country )

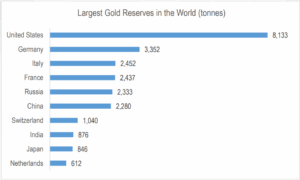

Global central banks own about 17% of all the gold ever mined, with reserves topping 37,755 metric tons (MT) at the end of 2024. They acquired the vast majority after 2010. The central banks with the largest reserves of gold are shown in the chart below:

(Source: https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/top-central-bank-gold-holdings/ ) According to the World Gold Council, Indian women collectively own around 24,000 tonnes of gold (roughly 11% of above ground reserves) in jewellery form. The value of this holding is estimated to have increased from $1.45 tn as of March 2024 to $ 2.02 tn as of March 2025. (Source: https://timesofindia.indiatimes.com/life-style/fashion/luxury/cover-story/indian-women-hold-11-of-the-worlds-gold-read-complete-report/articleshow/116435306.cms )

Over the last 5 years, RBI has bought about 227 tonnes of gold taking RBI’s gold reserves to 876 tonnes as of March 2025 (an increase of 34.3%). However, gold reserves spiked from $ 30.6 bn in March 2020 to $ 74 bn in March 2025, an increase of 142%. Gold reserves as a proportion of overall Forex reserves increased to 11.1%, the highest in 15 years and exceeding the previous high of 9.2% hit in 2012.

( Source: https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=22624 )

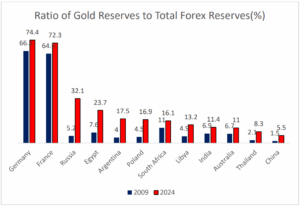

Notably, many countries hold their overall Forex reserves in the form of Gold. US, Germany, Italy and France hold between 68-72% of their forex reserves in gold. In fact, many central banks have significantly increased their gold holdings since 2009. The largest % increase in gold as a proportion of forex reserves by key central banks is shown below:

(Source: https://timesofindia.indiatimes.com/business/india-business/big-jump-in-gold-reserves-not-just-indias-rbi-central-banks-around-the-world-are-stocking-up-on-gold-heres-why/articleshow/121049340.cms ) HDFC Tru is the Investment Advisory arm of HDFC Securities Ltd; SEBI Registration No: INA000011538, which provides holistic Wealth Management Solutions to UHNIs, Family Office & Institutions. Please reach out to us at tru@hdfcsec.com or visit our website at www.hdfc-tru.com . You can also contact us at +91 9930203944