Global Capability Centres (GCCs): The New Growth Frontier

India’s office market is undergoing a fundamental transformation, propelled by the strong expansion of domestic firms and the nation’s world-class tech hubs, known as Global Capability Centres. This robust demand is sharply focused on high-quality, modern, and sustainable buildings, driving a flight to premium, integrated real estate. This powerful combination of economic growth and a clear preference for superior workspaces firmly establishes India as a global leader in the commercial real estate sector.

Executive Summary:

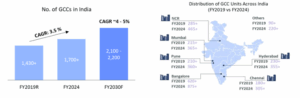

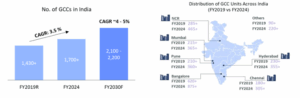

The Indian technology landscape has matured, moving beyond reliance on third-party service providers to position itself as the global nucleus for Global Capability Centres (GCCs). These captive hubs, established by both multinational corporations and domestic firms to handle specific business functions for their parents, are rapidly transitioning from mere cost arbitrage centres to value-enhancing transformation hubs, driving complex organizational and innovative initiatives worldwide. This market leadership is cemented by India hosting over 2,975+ GCC units as of Fiscal 2024, attracting approximately 23% of the Global 2000 MNCs to set up their captives in the country.

Source: WeWork RHP, NASSCOM, HDFC TRU.

- The focus is increasingly on value enhancement; transformation hubs grew at a 3.5% CAGR in the last five years (1,430+ in FY2019 to 1,700+ in FY2024), with a forecast to grow at 4–5% CAGR, reaching 2,100–2,200 by Fiscal 2030.

- Bengaluru leads the segment with 875+ GCCs in Fiscal 2024, followed by NCR (465+) and Mumbai (365+). Significantly, Bengaluru and NCR account for 47% of the IT talent within India’s GCC ecosystem.

- The demand for high-skilled personnel is set to surge, with global roles in GCCs forecast to increase nearly fivefold, from 6,500 roles today to over 30,000 roles by CY2030.

- This expansion is primarily supported by the availability of a skilled workforce at competitive costs, favorable government reforms (like Startup India and Digital India), and attractive competitive rentals.

- U.S.-based firms were responsible for over 68% of GCC leasing in India between 2022 and 2024. GCC Market Scale and Financial Impact

GCC Market Scale and Financial Impact

Source: WeWork RHP, NASSCOM, HDFC TRU.

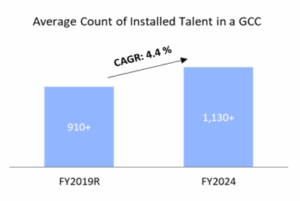

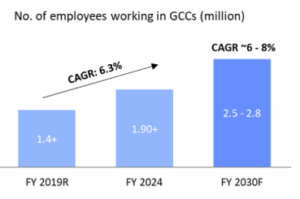

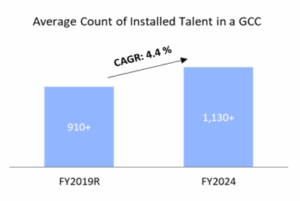

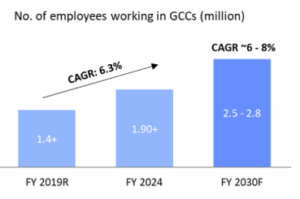

- The number of employees in GCCs increased at a 6.3% CAGR from 1.4+ million in Fiscal 2019 to over 1.9+ million in Fiscal 2024

- The employee base is projected to continue its strong growth, increasing at a CAGR of 6–8% and reaching 2.5–2.8 million by Fiscal 2030

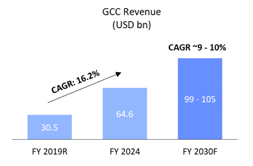

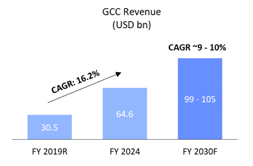

- GCC revenue surged from USD 30.5 billion in Fiscal 2019 to USD 64.6 billion in Fiscal 2024, and is forecast to reach USD 99–105 billion by Fiscal 2030.

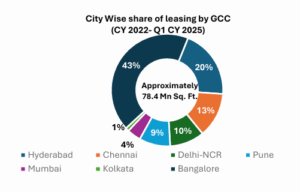

GCC Leasing Market Share

Source: WeWork RHP, NASSCOM, HDFC TRU.

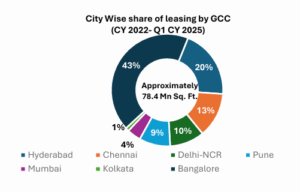

While Bengaluru continues to lead in GCC leasing, traction has increased in cities like Hyderabad, Chennai, Delhi-NCR, and Pune, driven by GCCs’ strategy to move closer to their talent pools and the enhanced availability of quality office supply.

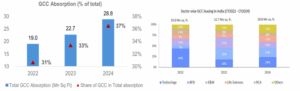

GCC: Office Space Absorption and Sectoral Diversification

Source: WeWork RHP, NASSCOM, HDFC TRU.

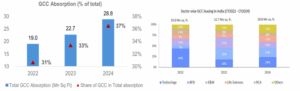

- GCC leasing, traditionally dominated by Technology and Engineering, saw an increased share in BFSI and Life Sciences firms during CY2023–CY2024, driven by demand from niche financial players like hedge funds and FinTechs.

- Over 40 global unicorns have established GCCs in India as of Fiscal 2024, with the highest presence in the Software & Internet and BFSI verticals.

- The growth of GCCs is reflected in the doubling of services exports to US$ 387 billion (2024-25), with ‘Other Business Services’ being the second-largest contributor to services exports in Fiscal 2024 with a 26% share.

- GCCs are increasingly opting for modern, integrated, and amenity-rich parks; approximately 64% of top leases in CY2024 were in green-certified assets that are less than 10 years old.

- GCCs are forecast to remain a key growth driver, with their share of total gross leasing projected to range between 35 – 40% during 2025–2026.