Our analysis shows that whenever Indian equity markets trade at stretched levels, FIIs turn net sellers, a pattern consistent across (1) 12-month Forward P/E, (2) Earnings yield vs. Bond yield, and (3) Trailing PEG frameworks. Strong growth alone is not enough; when price outruns fundamentals, foreign capital pauses. We believe that FIIs are not abandoning India’s story, they are simply waiting for valuations to reopen the gate.

Global equity capital is inherently price-disciplined, and valuations determine when it chooses to participate. We note that foreign investors (i.e. FIIs) are not structurally averse to India, but they are highly sensitive to the price at which growth is offered.

Across three independent valuation frameworks, we see that: elevated valuations coincide with FII net selling, while reasonable or compressed valuations tend to attract foreign inflows.

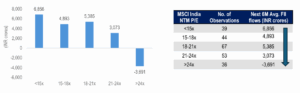

Figure 1: MSCI India 12-month Forward (NTM) P/E vs. Next 6-month Avg. FII Equity Net Flows

Source: Bloomberg, NSDL, HDFC TRU. Data Period: Jan, 2006 – Nov, 2025.

Figure 2: Gap between India Bonds Yield and Earnings Yield vs. Next 6-month Avg. FII Equity Net Flows

Source: Bloomberg, NSDL, HDFC TRU. Data Period: Jan, 2006 – Nov, 2025.

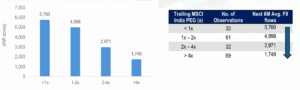

Figure 3: MSCI India Trailing PEG Ratio vs. Next 6-month Avg. FII Equity Net Flows

Source: Bloomberg, NSDL, HDFC TRU. Data Period: Jan, 2006 – Nov, 2025. Note: Trailing PEG = TTM P/E / 3-year TTM EPS CAGR.

Net-net, the above analysis highlights that FIIs are valuation-anchored, not momentum-chasing. Growth may be India’s long-term story, but stretched valuations often result in global capital waiting at the immigration counter rather than entering the market.