India’s digital payments market has experienced remarkable growth, with Person-to-Merchant (P2M) transactions increasing from ₹23.4 trillion in FY2020 to ₹111.8 in FY2025, reflecting a 37% CAGR. This surge has been driven by widespread adoption of UPI, cards, and supporting infrastructure such as QR codes and soundboxes, resulting in a significant shift toward non-cash payments. Currently, 45% of private consumption is digital, up from 19% in FY2020, and is projected to reach 79–81% by FY2029, reducing cash reliance from 81% to just 19–21%. India’s merchant base, estimated at 80–85 million, is still early in its digital journey, with 76% internet penetration and increasing adoption of advanced Digital Commerce Platforms among high-value merchants. DCP penetration is expected to rise from 10% to 19% by FY2029 as merchants seek integrated solutions beyond payment acceptance.

India’s Person-to-Merchant (P2M) digital payments sector has seen explosive growth, surging from a transaction value of ₹23.4 trillion (US$275 billion) in FY 2020 to ₹111.8 trillion (US$1.3 trillion) in FY 2025, representing a 37% CAGR. This rapid digitalization, facilitated by methods like UPI, credit/debit cards, and enabled by DCPs, soundboxes, and QR codes, means that 45% of all private consumption is now non-cash. The market is projected to more than double, reaching ₹244-264 trillion (US$2.9-3.1 trillion) by FY 2029. Both in-store and online P2M segments are key contributors; in-store transactions reached ₹58.0 trillion in FY 2025 and are expected to hit ₹120-131 trillion by FY 2029, while online transactions grew to ₹53.8 trillion and are projected to reach ₹123-134 trillion in the same period. Crucially, this digital shift has significantly reduced the country’s reliance on cash from 81% of all P2M payments in FY 2020 to 55% in FY 2025 and is further expected to fall to a mere 19-21% by FY 2029.

Source: Pine Labs RHP, HDFC Tru

India’s large merchant base, estimated at 80-85 million in FY 2025, is early in its digital adoption journey, with 76% connected to the internet. While the majority (69%) currently utilize low-cost solutions like QR codes and soundboxes, a growing segment of high-value merchants (10% of the base) are increasingly adopting sophisticated Digital Commerce Platforms (DCPs) to digitize beyond just payment acceptance. Merchants face challenges, including the complexity of integrating numerous payment methods and managing the proliferation of hardware/software at checkout. To address their evolving needs, businesses are looking for the next wave of commerce tools that encompass choice of form factor, hardware/software bundling, omnichannel commerce, digitized billing/ERP systems, and customer engagement tools like loyalty programs and analytics. Consequently, merchants seek a critical growth partner, not just a payment provider. This demand for more sophisticated infrastructure is expected to drive DCP penetration among merchants to 19% (19-20 million) by FY 2029 as the ecosystem matures.

Source: Pine Labs RHP, HDFC Tru

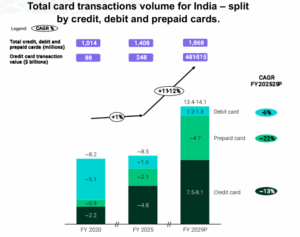

The digital payments card market in India, encompassing issuing and acquiring solutions for financial institutions, is poised for significant expansion, driven by the increased issuance of credit, debit, and prepaid cards. The total number of cards is projected to rise from approximately 1.4 billion in FY 2025 to 1.9 billion by FY 2029. This growth, however, masks diverging trends in transaction volumes across card types. Between FY 2020 and FY 2025, credit card transactions grew by 17% and prepaid transactions surged by 20%, while debit card transactions declined sharply by -21%. Looking ahead to FY 2029, prepaid cards are projected to lead transaction growth with a CAGR, followed by credit cards at a 13% CAGR, notably driven by the adoption of Credit Card on UPI. Conversely, debit card transactions are expected to continue their decline, projecting a -6% CAGR, indicating a substantial shift in consumer preference towards credit and prepaid options, alongside the pervasive growth of UPI.

Source: Pine Labs RHP, HDFC Tru