India is the world’s largest two-wheeler market, is driving its own EV revolution based on domestic strength, a break from the foreign-reliant ICE sector. Indian OEMs are making heavy domestic R&D investments, resulting in Indian-manufactured electric scooters that offer performance and a superior feature set. The primary consumer appeal is the Total Cost of Ownership (TCO). While the initial price may be higher, running costs per kilometer are drastically lower, making E2Ws highly economical over the long term. The transition is actively fueled by the government through Central Subsidies (like FAME-II/PM E-DRIVE) that reduce the upfront cost. Infrastructure is evolving rapidly with Battery Swapping (BaaS) models to address range anxiety, especially for commercial fleet operators. This has created a dynamic, highly competitive market between startups and legacy automotive giants.

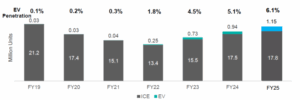

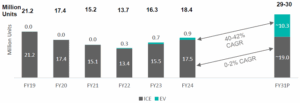

Two-wheelers represent an easily accessible and vital mode of personal transportation throughout both India’s urban and rural landscapes. Although motorcycles maintain the highest popularity, the market is currently seeing a significant surge in the prevalence of scooters, while the share of mopeds is declining. The usage is functionally dominated by utility: the primary application is commuting to workplaces, followed closely by the second-largest segment, business-related activities, which includes extensive reliance on two-wheelers for last-mile delivery services (food, goods, mail, and courier). The industry’s robust growth is structurally driven by macroeconomic factors such as rising per capita income, continuous improvements in infrastructure and urbanization, and ironically, the necessity of navigating worsening traffic congestion. These drivers have resulted in a steady increase in vehicle density, with two-wheeler penetration rising from approximately 106–108 per 1,000 people in FY19 to an estimated 116–118 in FY24. In the last 5 years, the electrification within the industry has helped grow the industry sales. During fiscal 2019 to fiscal 2024 period, ICE segment contracted at 3.7% CAGR while EV retails grew with a 101.7% CAGR, albeit from a lower base. In fiscal 2025, EV penetration reached around 6.1% and EV volumes reached 1.15 million units.

Source: Aether Energy RHP.

In India, the EV two-wheelers (E2W) are gaining popularity enabled by the government’s support via Faster Adoption and Manufacturing of Hybrid and Electric vehicles (FAME II), EMPS subsidy and the latest PM E-drive subsidy, state subsidies and tax rate cuts coupled with growing awareness and concern for environmental issues. An expanding E2W portfolio of tech – enabled at lower acquisition costs has driven consumer interest in and accelerated the growth of E2Ws in India. Significant strides in product evolution are one of the primary reasons for the sharp growth witnessed in the E2W segment in India. Driven by economies of scale and declining lithium-ion cell prices, the initial purchase price gap is rapidly closing. This trend, combined with subsidies, is pushing the EV two-wheeler price closer to price parity with conventional ICE vehicles, making the lower TCO immediately appealing to mass-market consumers.

Source: Aether Energy RHP.

India is the largest 2W market in the world (by sales volume). Unlike ICE vehicles, wherein the technology was developed outside India and then brought to India through joint ventures, Indian OEM’s have been investing heavily in R&D and developing the core technology for EV products.

Electric scooters manufactured in India offer a higher number of features and similar performance, compared to majority of global peers. For example, Indian electric scooters offer features like on-board navigation, ride statistics, geo-fencing, and hill hold technology.

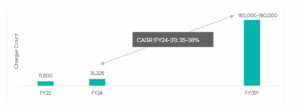

The government is actively promoting charging infrastructure and battery swapping to support the EV ecosystem in India. The plan is to establish five lakh public charging stations (PCS) by 2025, by offering financial assistance to states and private companies. This initiative addresses the lack of charging infrastructure which is a key barrier to EV adoption.

Further through the revised guidelines and standards for charging infrastructure issued by Ministry of Power, the government aims to augment the station density/distance between two charging stations as below:

Source: Aether Energy RHP.