Since SEBI introduced Specialized Investment Funds (SIFs) in February 2025, the category has quickly gained traction, signaling a new era in the investment landscape. In just a few months, seven leading AMCs have already launched their SIF brands and rolled out three distinct schemes. This rapid activity indicates early adoption and growing industry confidence.

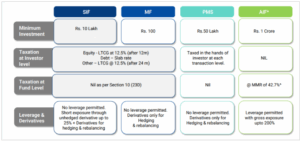

Strategically positioned between mutual funds and high-ticket products like PMS and AIFs, SIFs combine the tax advantages of mutual funds with the flexibility to use advanced strategies, offering investors a structured yet adaptable approach.

A Specialized Investment Fund, or SIF, is a type of investment vehicle that has been introduced in February 2025 by SEBI to bridge the gap between traditional mutual funds and high-ticket investment products like Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs).

It is designed to offer the “taxation benefit of a mutual fund” along with the “flexibility of a PMS/AIF”.

SIFs are suitable for investors who seek a balance of regulatory safety, tax efficiency, and greater flexibility in managing their wealth.

OR

Source: Edelweiss

Note: Taxation for SIFs will be at the scheme level in the hands of the investor.

Minimum investment of Rs 10 Lakh applies per PAN per AMC.

STCG for SIF and Mutual fund: Equity (upto 12 months) – 20%; Debt – slab rate; Others (upto 24 months) – slab rate.

* CAT III AIF assuming that it will be a business income product. ^ Incl applicable cess & surcharge

To summarize,

Source: SEBI

To avoid proliferation of investment strategies and in line with the approach followed for categorization of MF schemes, only one investment strategy is permitted to be launched under each of the aforementioned sub-categories.

Long-Short strategy is the key feature of SIFs, aiming for consistent, absolute returns regardless of market direction. Managers take ‘long’ positions in strong stocks and simultaneously ‘short’ (via derivatives) weak stocks. This dual approach creates a hedged portfolio to mitigate market risk. SEBI mandates capping of unhedged short exposure at 25% of the NAV.

SIF schemes employ a range of additional derivative strategies for active risk management and supplemental returns. These include Covered Calls for income, Short Straddles/Strangles to profit from low market volatility, Pair Trades to exploit relative value, and Arbitrage for low-risk, steady gains from market mispricing.

| AMC | SIF Brand Name | Scheme Name | NFO Open Date | NFO Close Date |

| Edelweiss Mutual Fund | Altiva SIF | Altiva Hybrid Long-Short Fund | 01-Oct-25 | 15-Oct-25 |

| SBI Mutual Fund | Magnum SIF | Magnum Hybrid Long-Short Fund | 01-Oct-25 | 15-Oct-25 |

| Quant Mutual Fund | QSIF | QSIF Equity Long-Short Fund | 17-Sep-25 | 01-Oct-25 |

Source: SEBI

Beyond the AMCs that have already launched the above schemes, the following AMCs have registered their SIF platforms/brands with SEBI.

| AMC | SIF Brand Name |

| Mirae Asset Mutual Fund | Platinum SIF |

| ITI Mutual Fund | Diviniti SIF |

| DSP Mutual Fund | Endurance SIF |

| Bandhan Mutual Fund | Arudha SIF |

Source: SEBI

In summary, Specialized Investment Funds (SIFs) redefine modern investing. They deliver structured, actively managed solutions that prioritize risk-adjusted, absolute returns across market cycles. For experienced investors, SIFs are a clear choice: a tax-friendly and regulated way to invest that helps enhance portfolio resilience and find opportunities that traditional investments like MFs often miss, making it an attractive proposition for discerning investors.