SDLs - Yields wilting under the Borrowing Load

States are flooding the bond market with debt – SDL yields spiking, spreads ballooning close to 100 bps, way above norms.

G-Secs ease while states’ large borrowings strains supply, with pension funds and insurers pulling back.

Charts expose the squeeze. Relief? Not till H1 FY27, when borrowing finally slows.

Introduction

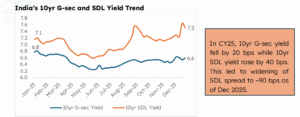

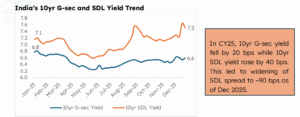

Indian states have borrowed heavily through State Development Loans (SDLs) in FY26, causing their yields to rise much faster than central Government Securities (G-Secs). This easy-to-read note breaks down the yield gap, explains why it happened, and covers what it means for bonds.

India’s 10yr G-sec and SDL Yield Trend

Source: Bloomberg, RBI, HDFC TRU; Note – Data as of 31st Dec 2025

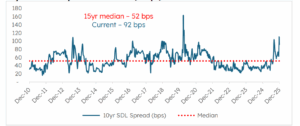

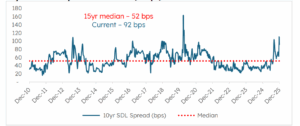

10yr SDL Yield Spread over G-sec (in bps)

Source: Bloomberg, RBI, HDFC TRU; Note – Data as of 31st Dec 2025

- Spreads show high volatility, spiking repeatedly above 100 bps (e.g., 2013, 2016, 2019, 2020, 2025), often during heavy state borrowing phases or tight liquidity.

- In CY25, SDL spreads reached near 100 bps amid large state borrowings, far exceeding the 15yr median average of 52 bps.

- Current spread at 92 bps remains elevated versus historical norms, reflecting persistent supply pressures.

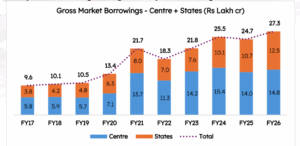

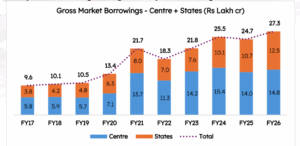

Heavy state borrowing leading to SDL spread widening

Source: RBI, HDFC TRU

Note – FY26 figures are based on actual borrowings plus calendars announced for H2 and Q4 FY26

The chart above shows a steady, broad-based rise in gross market borrowings by both the Centre and states over FY17–FY26, with a noticeably faster pickup in state borrowing in recent years.

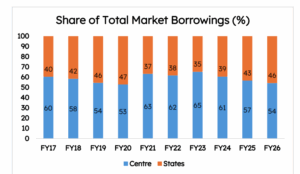

- Total market borrowings have climbed from around ₹9.6 lakh crore in FY17 to ₹27.3 lakh crore in FY26, with states contributing an increasingly larger chunk of the incremental borrowing.

- State borrowings have more than tripled from about ₹3.8 lakh crore in FY17 to ₹12.5 lakh crore in FY26, indicating a sharp increase in reliance on market funding.

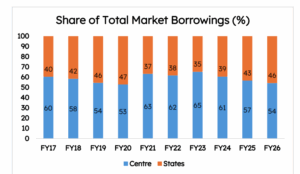

- The state share in total market borrowings has risen meaningfully, with the state bar expanding faster than the Centre’s, especially from FY21 onwards.

Source: RBI, HDFC TRU

Our Take:

- State borrowing pressures are unlikely to fade quickly.

- With Q4 FY26 SDL issuance at about ₹5 lakh crore, the market is already grappling with an unfavourable demand–supply mix amid expectations of only limited fiscal consolidation.

- Furthermore, the demand from long term players including banks, pension funds, and insurance companies has tapered amid regulatory changes.

- Banks – RBI has discontinued the previous practice that allowed banks a routine annual one-time transfer of securities from the Held to Maturity (HTM) to the Available for Sale (AFS) portfolio.

- Pension – Pension funds are allowed to hold 25% of assets in equity against earlier limit of 15%.

- Insurance – Slower annuity premium growth after tax changes has reduced demand for matching long bonds.

- Against this backdrop, 10-year SDL spreads over G-Secs are expected to stay elevated till March 2026.

- Spreads are likely to ease in H1 FY27 as state borrowing tapers, in line with the usual back-ended issuance pattern within the fiscal year.

- Investors mandated to hold government securities – whether by regulation or internal policy – can tilt toward higher SDL allocations to capture the attractive elevated spreads over G-Secs.