In the past few quarters, rural India has been shouldering the responsibility of consumption growth in the country while urban mass consumption remained soft, impacted adversely by persistent inflation.

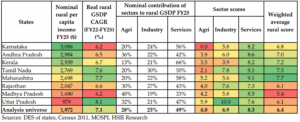

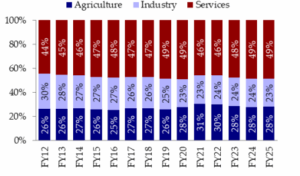

Rural India is transitioning swiftly from an agri-centric economy to a servicesled economy. 112 rural districts representing a population of 291mn have already crossed the threshold of per capita income of USD2,000. This pool of wealthy individuals is expected to drive sustained demand for discretionary products and services. (Source- HSIE Research Report).

(Source- HSIE Research Report)

The increasing pool of wealthy individuals in rural areas (those with over USD 2,000 per capita income) is anticipated to drive a sustained demand for discretionary products and services, indicating a shift in consumption patterns as income levels rise.

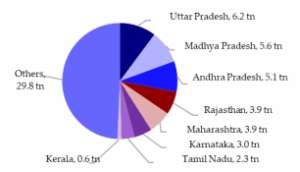

Overall nominal GDP of analysis universe (INR 109 tn)

(Source- HSIE Research Report)

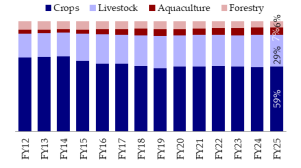

Rural India’s agriculture sector, accounting for 51% of the nation’s rural agriculture, grew at a real CAGR of 3.9% from FY2022-FY2025, lagging behind overall rural growth. While crops (59% share) grew at a mere 2.8%, livestock (29%) and aquaculture performed better at 5% and 7.4% respectively, though all three subsectors saw decelerated growth compared to previous periods. Uttar Pradesh and Maharashtra posted positive agricultural growth, while Karnataka saw a decline. Nominal agri per capita income stood at USD 1,145 in FY2025.

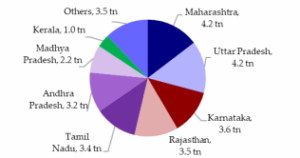

Agri GSDP across states (FY25: INR 60.5 tn)

Nominal agri GDP for analysis universe (FY25: INR 30.7 tn)

(Source- HSIE Research Report)

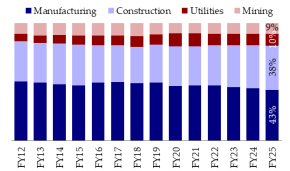

The rural industry sector, representing 88% of rural industry in India, grew at a 7.1% real CAGR from FY2022-FY2025, aligning with overall rural growth. This was largely driven by strong performances in mining (13.5%), construction (8.7%), and utilities (6.9%), despite manufacturing lagging at 5%. Uttar Pradesh led state-level growth with a 10.6% real CAGR, while Kerala’s growth was muted at 3.7%. Notably, nominal per capita income in the industry sector surpassed USD 2,000 across almost all states, with Uttar Pradesh being the exception, still above USD 1,000.

Industry GSDP across states (FY25: INR 28.7tn)

Nominal industry GDP for analysis universe (FY25: INR 25.2 tn)

(Source- HSIE Research Report)

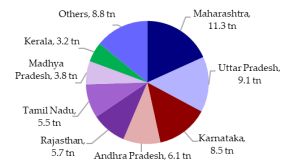

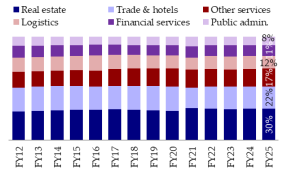

The rural services sector, covering 86% of India’s rural services, grew at a robust 8.8% real CAGR from FY2022-FY2025, outpacing overall rural growth. This expansion was primarily led by strong performances in trade & hotels (9.8% CAGR) and financial services (9.1% CAGR), while public administration (6.9% CAGR) was a drag. Key segments like real estate, logistics, and financial services significantly improved their growth rates compared to pre-COVID levels. Tamil Nadu and Maharashtra led state-wise growth for the sector, both achieving 9.6% CAGR, though Rajasthan underperformed at 7.6%. Notably, the services sector’s nominal per capita income has now exceeded USD 3,000, with all states above USD 2,000.

(Source- HSIE Research Report)

Services GSDP across states (FY25: INR 62 tn)

Exhibit 50: Nominal services GDP for analysis universe (FY25: INR 53.2 tn)

(Source- HSIE Research Report)