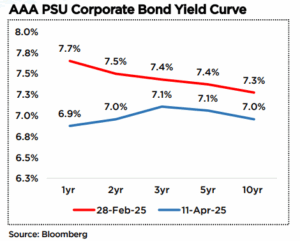

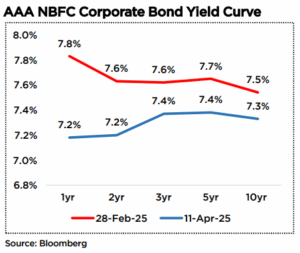

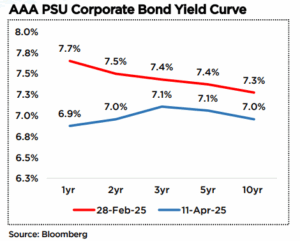

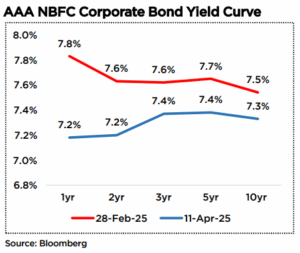

Inversion to Steepening : Repricing of Corporate Bond Yield Curve

FY25 witnessed an abnormal phase of yield curve inversion in the corporate bond market. This inversion was caused by tight liquidity conditions, large supply of securities in money market segment and cautious investor sentiment. However, the yield curve has seen a notable shift recently with the curve steepening as liquidity improved, RBI cut rates and maintained a dovish monetary policy stance.

What led to corporate bond yield curve inversion?

- Huge supply of money market instruments – During FY25, fundraising via commercial papers (CPs) was at a 3-year high (Rs 10.6 lakh cr), whereas funding via certificates of deposit (CDs) was highest in 5 years at Rs 13.2 lakh cr.

- Tight liquidity conditions – During Q4 FY25, banking system liquidity was in large deficit (avg. liquidity deficit of Rs 1.6 lakh cr) leading to elevated short-term rates.

- Favorable demand supply dynamics at longer end – Longer end of the corporate bond segment witnessed healthy demand from insurance companies, pension funds, and provident funds, among others.

Why is yield curve steepening now?

- Surplus banking system liquidity – In first half of Apr’25, liquidity surplus has averaged Rs 1.7 lakh cr.

- RBI’s dovish stance – RBI has cut repo rate by 50 bps so far and has changed its stance to accommodative.

Way Ahead

RBI is expected to cut repo rate further by 50 bps to 5.5% from current 6.0% in 2025. RBI’s dovish stance coupled with surplus banking system liquidity is likely to further steepen the corporate bond yield curve in the near to medium term.