RBI’s Surprise CRR Cut: A Strategic Push for Surplus Liquidity

Background

- In a surprising move that caught the market off-guard, the RBI announced a 100 basis points (1%) cut in the Cash Reserve Ratio (CRR) in its June 2025 Monetary Policy Committee (MPC) meeting.

- This move is aimed at keeping adequate liquidity surplus in the near to medium term to achieve effective and quicker monetary policy transmission.

- This note delves into what CRR is, its role in monetary policy, CRR’s historical trend, and RBI’s decision and its impact on liquidity, bond yields, and the banking sector.

What is CRR?

- The Cash Reserve Ratio or CRR is the minimum percentage of a bank’s Net Demand and Time Liabilities (NDTL) that must be maintained as cash reserves with the RBI.

- This means banks are required to set aside a certain portion of their NDTL (includes savings account, current account and fixed deposits) in the form of cash with the RBI, and these funds cannot be used for lending or investment purposes.

Calculation of CRR

-

- CRR Amount = CRR % x NDTL

- For example, if a bank has an NDTL of ₹1 lakh cr and the CRR is 5%, the bank must maintain ₹5,000 cr with the RBI.

- This calculation is done on a fortnightly average basis. Banks need to ensure they meet the prescribed CRR level on an ongoing basis, using their daily balances to maintain the average.

Role of CRR in Monetary Policy and Implications for Banks

- CRR is a key monetary policy tool used by the RBI to regulate liquidity in the banking system. By adjusting the CRR, the central bank can directly influence the money supply in the economy.

- For example, a higher CRR means banks must keep more funds with the RBI, which tightens liquidity and controls inflation. Conversely, a lower CRR releases more funds into the system, boosting lending and economic activity.

- Importantly, the RBI does not pay any interest on the funds maintained by banks as CRR.

- This effectively represents an opportunity cost for banks, as these funds earn no return while being held with the central bank.

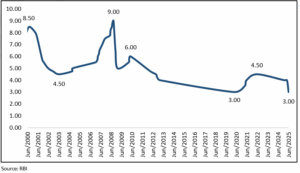

Historical CRR Trend (% of NDTL)

RBI’s Recent Action on CRR and Its Impact

- The RBI decided to reduce the CRR by 100 bps to 3% of NDTL in its June 2025 MPC meeting.

- This reduction will be carried out in four equal tranches of 25 each during Sep-Nov 2025.

- Liquidity Impact: As per RBI, this cut in CRR would release primary liquidity of about ₹2.5 lakh cr in the banking system by Dec 2025.

- Bond Yield Impact: Additional liquidity could lead to fall in yields especially at the shorter end of the yield curve.

- Banking Sector Impact: CRR cut would reduce the cost of funding of the banks, thereby helping in monetary policy transmission to the credit market.

Conclusion

- The RBI’s 100 bps CRR cut in June 2025 is a decisive move to ease liquidity constraints, lower bond yields, and boost bank lending.

- As CRR sits at a historic low of 3%, it underscores the RBI’s priority to support credit growth and strengthen monetary policy transmission.

- The next few quarters would reveal how effectively banks channel this liquidity to revive economic momentum.