From Mint to Market: RBI’s Dividend and its Ripple Effects

RBI’s Record Dividend to Centre

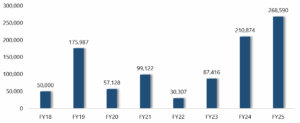

- RBI declared its highest-ever dividend of ₹2.69 lakh cr to the central government for FY25, ~27% higher than the ₹2.11 lakh cr payout in FY24.

- Centre had budgeted ₹2.56 lakh cr as divided in FY26 from RBI and PSU banks/financial institutions combined. RBI’s dividend alone has surpassed the Centre’s budget estimate for FY26.

- However, RBI’s FY25 dividend was lower than the recent market estimate of ₹3-3.5 lakh cr, as RBI decided to increase the risk buffer by 1% in FY25.

Source: RBI, Union Budget FY26, ET, Financial Express

This note explores RBI’s dividend trend, how the RBI earns its income, the mechanism behind determining the dividend payout, and the potential implications for markets, particularly on liquidity, bond yields, and the broader financial sector.

RBI’s dividend payout to Centre over the years (₹ cr)

Source: RBI

Various Sources of RBI’s Income

- Repo Operations: Interest income from lending to banks under liquidity adjustment facility (LAF)

- Forex Reserves: Returns from investments in forex reserves such as global sovereign bonds

- Forex Transactions: Profits from foreign currency buying/selling

- Domestic Assets: Interest income from investments in Indian government securities

- Open Market Operations (OMOs): Profits from bond buying/selling in the secondary market

- Others: Currency management income (Seigniorage), fee income, and valuation gains

Source: RBI

How is Dividend/Surplus Decided by the RBI?

Economic Capital Framework (ECF):

- Introduced in 2019, ECF framework determines the amount of contingency reserves RBI must maintain to absorb potential risks.

- Based on this, the surplus or the profits over the required reserves is eligible for transfer as dividend to the government. Higher provisions imply lower dividend and vice versa.

- Contingency Risk Buffer (CRB) for FY25 was increased to 7.5% (as a % of RBI’s balance sheet size) vs 6.5% in FY24.

- RBI’s balance sheet size was ~ ₹75 lakh cr as of Mar 2025. 1% increase in CRB translates to around ₹75,000 cr increase in provisions

Source: RBI

Key Implications of RBI’s Dividend

- Banking System Liquidity: Liquidity surplus may further improve from the current levels of ₹1.6 lakh cr (avg. liquidity in May 2025 so far), as government spends this dividend in coming months.

- Fiscal/ Bond Yield Positive: Government could utilize a part of this dividend to lower the gross market borrowings for FY26 which could be positive for domestic bond yields.

- Higher Capex/ Growth Positive: Keeping market gross borrowings constant, government could opt to spend this dividend towards capex creating tailwind for higher economic growth.