In an era defined by market unpredictability and evolving investor expectations, Multi Asset Allocation Funds have emerged as a powerful solution for balancing growth and stability. By seamlessly blending equity, debt, and commodities, these funds offer a dynamic, all-weather strategy that adapts to changing economic landscapes. With rising AUM and expanding scheme count, they reflect a growing shift in investor mindset toward smarter diversification and long-term wealth creation.

Asset allocation is the cornerstone of modern portfolio management, referring to the strategic distribution of investments across various asset classes such as equities, fixed income, commodities, and cash equivalents to balance risk and reward according to an investor’s goals, risk tolerance, and investment horizon.

The significance of asset allocation lies in the fact that it is widely considered the most crucial factor in determining a portfolio’s long-term returns. Rather than timing the market or selecting individual securities, the decision of how much to allocate to each asset class is paramount.

Ultimately, a robust asset allocation strategy ensures that an investor’s portfolio remains aligned with their objectives over decades, enforcing a disciplined approach that mitigates the risk of emotional, reactive investment decisions during periods of market euphoria or panic.

Multi Asset Allocation Fund

Prior to SEBI’s transformative circular in October 2017, the Indian mutual fund industry was marked by a lack of standardization, with numerous schemes bearing similar objectives but differing names and unclear mandates. This created confusion for investors, making it challenging to evaluate and compare funds effectively. To address this, SEBI implemented a structured classification and rationalization framework, bringing clarity and consistency to mutual fund offerings. This move significantly improved transparency and investor confidence, reshaping the regulatory landscape.

A Multi Asset Allocation Fund is designed to invest in a mix of at least three distinct asset classes commonly equity, debt, and commodities like gold or silver—and may also include instruments such as REITs and InvITs. In line with SEBI’s rules, these funds maintain a minimum 10% allocation in each asset class. They are actively managed to adapt to market dynamics, offering diversified exposure and aiming to reduce volatility while delivering stable, risk-adjusted returns through strategic rebalancing.

Advantages of Multi Asset Allocation Funds

- Diversification Across Asset Classes

- Helps avoid taxes on frequent rebalancing, making diversification more tax-efficient

- Reduced Volatility

- Professional Management

- Inflation Hedge

India’s Multi Asset Allocation Fund Landscape: From Emergence to Expansion

Source: ACE MF

- AUM grew by 11x from ₹12,636 crore in January 2018 to ₹1,50,562 crore in September 2025.

- Schemes and AUM saw a sharp rise from 2023 onward, with schemes increasing from around 10 to 31 and AUM crossing ₹50,000 crore.

- Strong correlation (≈0.98) between AUM growth and scheme expansion, highlighting product launches as a key growth driver.

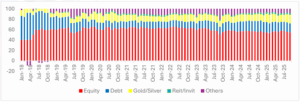

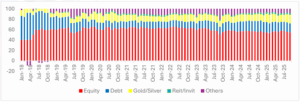

Asset Allocation Trends of Multi Asset Allocation Funds

Others Include Cash and Cash Equivalents, Derivatives Positions and International Exposures. Source: ACE MF

- Equity allocation has remained consistently within the 40–60% range, indicating a moderate risk profile and offering downside risk protection during sharp market correction

- Debt exposure on an average has been around 20% throughout the period, providing portfolio stability. A few funds exhibit higher debt allocation, though these are limited in number.

- Allocation to gold and silver has increased notably in recent years, contributing to outperformance during recent commodity rally; however, overall exposure has remained approximately under 15%.

- Exposure to REITs and InvITs has been minimal, reflecting limited diversification into these instruments.

- The “Others” category comprising cash and cash equivalents, derivative positions, and international exposures has been consistently present, signalling active liquidity management and tactical positioning for risk mitigation and global diversification

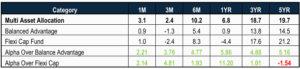

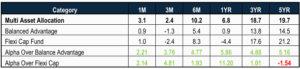

Performance Analysis of Multi Asset Allocation Funds vs. Balanced Advantage Funds & Flexicap

Data as of 30 Sep 2025. Source: ACE MF. Returns calculated are for Direct plans. Returns above 1 year are in CAGR terms

- Multi asset funds have consistently outperformed both flexicap and balanced advantage funds. The only exception was a marginal alpha generated by flexicap funds over a five-year horizon.

- This outperformance can be largely attributed to the recent rally in gold and silver. However, it’s important to note that this is not the sole driver. The inclusion of debt instruments within multi asset portfolios has also played a crucial role, acting as a buffer during the challenging market conditions witnessed over the past year.

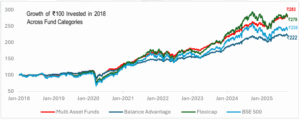

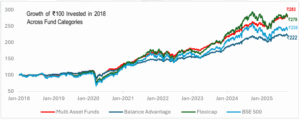

Cumulative Return Performance

Data from Jan 2018 to 30 Sep 2025. Source: ACE MF. Returns calculated are for Direct plans.

Data from Jan 2018 to 30 Sep 2025. Source: ACE MF. Returns calculated are for Direct plans.

- Analysis indicates that during market downturns, multi-asset funds have consistently demonstrated resilience and outperformance, largely attributable to their diversified portfolios, which include allocations to debt and commodities. In contrast, flexicap funds have generally mirrored benchmark movements during these periods.

- However, in bullish market phases, flexicap funds have fared well, primarily due to their higher equity exposure, which enables them to benefit more significantly from upward market momentum.

Rolling Return Performance 2018-2025

Data as of 30Sep 2025. Source: ACE MF. Returns calculated are for Direct plans.

- Multi asset funds have consistently outperformed balanced advantage funds across various rolling periods. However, flexicap funds have shown stronger performance in this metric. This is largely due to the nature of rolling returns, which average performance across different market cycles, including periods of equity-led rallies where flexicap funds tend to benefit more.

Conclusion

- Asset allocation plays a vital role in building a well-managed portfolio.

- Multi Asset Funds offer flexibility through dynamic allocation across asset classes, based on prevailing market conditions.

- Fund managers actively rebalance portfolios to maintain optimal exposure.

- Internal rebalancing by the fund manager helps avoid taxes on individual transactions, making diversification more tax efficient.

- Debt allocation within multi asset funds enjoys a taxation advantage taxed at 12.5% after 2 years, compared to marginal taxation in traditional debt mutual funds