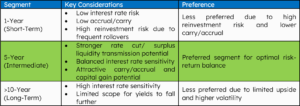

Amid evolving interest rate dynamics, the sweet spot for fixed income investors lies in the intermediate segment – balancing accrual yield, capital gain opportunity, and manageable risk. Short maturities face reinvestment hurdles, while long durations offer limited upside in today’s curve. Strategic yield curve positioning unlocks optimal risk-adjusted returns.

The RBI’s Monetary Policy Committee (MPC) delivered a dovish pause at its October 2025 meeting, unanimously voting to keep the repo rate unchanged at 5.5%. While the MPC maintained its neutral policy stance, this decision was not unanimous as 2 out of 6 MPC members favoured shifting to an accommodative stance. Additionally, the RBI Governor noted that there is a scope for monetary policy to further support economic growth.

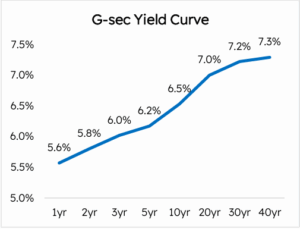

In this context, market participants are increasingly expecting additional repo rate cuts of 25–50 bps in the current cycle. The quantum and timing of rate cuts will depend on growth-inflation dynamics. Against this backdrop, we examine yields and spreads across segments to identify best risk-adjusted positioning for fixed income investors.

Yield curve positioning is a critical strategy in fixed income allocation, as selecting the right segment of the yield curve strongly influences risk-adjusted returns. In this note, we identify the optimal ‘sweet spot’ for fixed income investors to target in the current interest rate environment.

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025

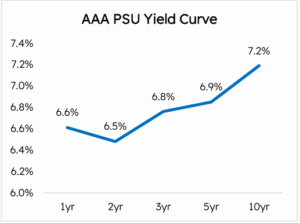

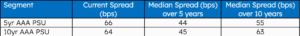

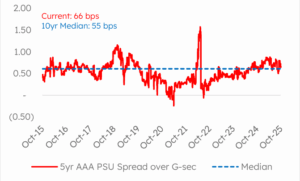

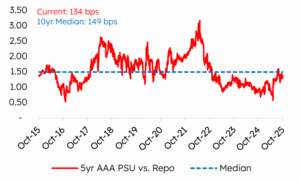

Current spread in 5-year AAA PSU segment over corresponding G-sec is higher as compared to 5yr and 10yr median spread. However, current 10-year AAA PSU spread is higher than 5yr median but in line with 10yr median spread. This makes 5-year segment more lucrative from an accrual or carry perspective.

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025; Spread is calculated over corresponding tenure G-sec

We have recently highlighted that long duration strategy is not a preferred segment given the unfavourable bond demand-supply dynamics and expectations of softer FY26 nominal GDP growth (reducing the scope for fiscal consolidation). Read here.

In addition, we also note that long-term bond yields are largely driven by longer term growth-inflation expectations, and may not respond much to interest rate cuts, especially towards the end of the interest rate cut cycle.

We therefore believe that intermediate duration is more likely to benefit from further interest rate cuts and surplus banking system liquidity which typically accompanies easing monetary policy cycle.

Source: HDFC TRU

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025

The 5-year AAA PSU yield spread over corresponding G-sec is currently higher at 66 bps vs historical median of 55 bps. This provides some cushion for transmission of rate cuts and surplus liquidity to 5yr AAA PSU yields.

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025

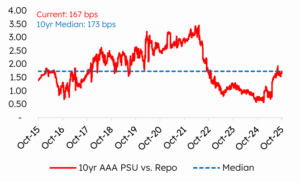

The 5-year AAA PSU yield spread over repo currently stands at 134 bps, slightly lower than 10-year median of 149 bps. The 10-year AAA PSU yield spread over repo is currently 167 bps, near its 10-year median of 173 bps. Our Preference: While the spreads for both 5 and 10-year are around historical medians, we favour the 5-year AAA PSU segment due to its lower interest rate sensitivity and greater likelihood of benefiting from further rate cuts and surplus liquidity.

Current yield spreads in 5 and 10-year AAA PSU segments are aligned with historical norms, indicating fair valuation. With the possibility of further repo rate cuts and surplus liquidity, the 5-year AAA PSU segment stands out as an attractive avenue for capital gains, owing to its lower interest rate sensitivity and stronger transmission potential. Investors should remain vigilant on growth and inflation trends to strategically leverage these opportunities.

Source: Bloomberg, HDFC TRU; Note – Data as of 31st Oct 2025