The Indian bond market is presenting a compelling puzzle: an unusually high term spread between long-term yields and the repo rate. Our analysis suggests this disconnect is an anomaly poised to correct. This note details the key drivers – RBI’s pro-growth agenda, improved fiscal credibility, pending global tailwind and India’s sovereign credit rating upgrade that support a bullish outlook on long-duration bonds. Read on to understand why we believe the yield curve is set to flatten.

Background

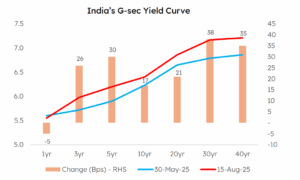

The G-sec yield curve in India has shifted upward following the last two RBI Monetary Policy Committee (MPC) meetings, driven by shifting policy signals.

- Jun’25 MPC: A larger-than-expected 50 bps repo rate cut, but market was surprised by change in policy stance from accommodative to neutral.

- Aug’25 MPC: The MPC announced a hawkish pause, setting the bar for future rate cuts higher.

This policy uncertainty has directly impacted bond yields. The RBI’s data-dependent approach means future rate cuts hinge on two key factors:

- Inflation Trajectory: The RBI has revised down its inflation forecast for FY26 by 60 bps to 3.1%. However, inflation is projected to rise above the RBI’s medium-term target of 4% by Q1 FY27.

- Economic Growth: The RBI remains positive on growth. Any future rate cut would be contingent upon growth weakening and inflation remaining supportive.

In essence, the market is grappling with the uncertainty of future policy easing, leading to an upward pressure on bond yields.

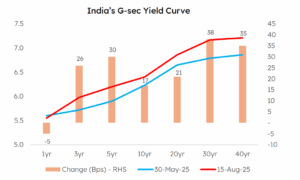

India’s G-sec Yield Curve

Source: Bloomberg, HDFC TRU

Since May’25, 3yr and above G-sec yields have risen by 20-40 bps. Long tenure (30/40yr) bond yields have seen a larger increase of >35 bps. 1yr G-sec yield has fallen by 5 bps since May’25 end largely on account of surplus liquidity in the banking system.

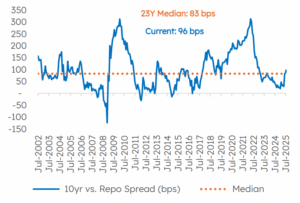

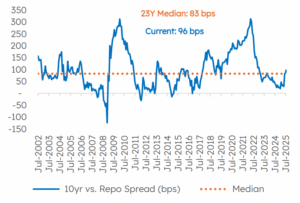

Term spread has widened post last two MPC meetings

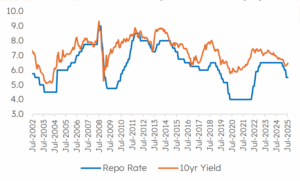

The median spread between India’s 10yr G-sec yield and repo rate over last 23 years has been 83 bps.

If we exclude two periods of 2009-2010 (post GFC-crisis) and 2020-2022 (Covid), the median spread narrows to 66 bps.

Compared to this historical term spread, the current spread is 96 bps which is on a higher side and could compress from current levels.

This compression in spread is likely to be achieved through a fall in 10yr yield rather than a rise in repo rate as interest rate cycle is expected to remain on a long pause considering the medium-term growth-inflation dynamics.

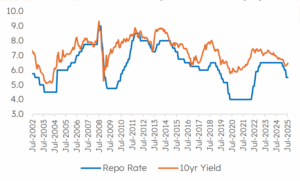

Historical trend of India’s repo rate and 10yr yield

Source: Bloomberg, HDFC TRU

India’s 10yr yield vs. repo rate spread (bps)

Source: Bloomberg, HDFC TRU

Apart from mean reversion discussed above, why we think India commands a lower term spread today.

- RBI’s pro-growth approach – The RBI’s goal is to revive credit growth (currently in single digit) and boost the economy. To achieve this, it has cut the repo rate by 100 bps since Feb’25 and injected large amounts of liquidity. A high term spread works against these efforts by keeping long-term borrowing costs high, thus hindering the transmission of policy actions to the economy. To ensure its pro-growth policies are effective, the RBI would be averse to maintaining such a high term spread.

- Fiscal Credibility – The government’s strong commitment to fiscal consolidation provides a solid foundation for lower long-term yields. By consistently working to reduce the fiscal deficit and offering a credible roadmap for debt management, the government has reduced the risk associated with future borrowing. The current high term spread is therefore inconsistent with this improved fiscal credibility, suggesting it should narrow to reflect the more favourable and stable fiscal environment.

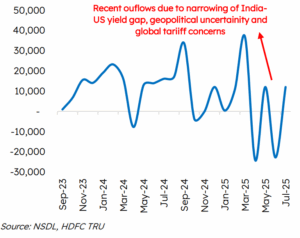

- Global Tailwind – As weaker US economic data emerges over the coming quarters; it could likely compel the US Fed to begin cutting interest rates (market expects 85-90% probability of rate cut in Sep’25 FOMC meeting). This would cause US bond yields to fall, making the relative yield on Indian bonds far more attractive to international investors. These foreign flows are expected to return to India’s bond market, pushing down long-term yields and thereby helping to narrow the term spread.

- India’s Sovereign Rating Upgrade – S&P Global Ratings has upgraded India’s sovereign credit rating to ‘BBB’ from ‘BBB-’, the first such upgrade in 18 years. This is a strong vote of confidence in India’s economic resilience and fiscal management. This development is particularly significant for foreign flows. The rating upgrade makes Indian government bonds more attractive to a wider base of foreign institutional investors, including those with investment mandates tied to specific credit rating thresholds.

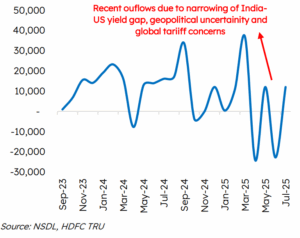

Monthly Debt FPI Flows (Rs cr)

Source: NSDL, HDFC TRU

- India’s sovereign rating upgrade to ‘BBB’ significantly lowers the perceived risk of Indian debt and expands the universe of foreign investors who can now invest in Indian bonds.

- This not only opens the door to new FPIs but also provides a strong catalyst for a reversal of the recent outflow trend, creating a powerful new source of demand that could put downward pressure on long-term yields.

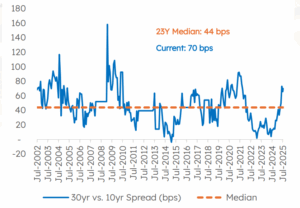

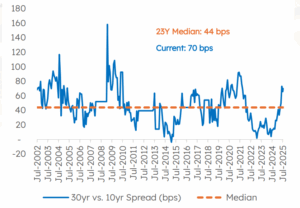

India’s 30yr vs. 10yr yield spread (bps)

Source: Bloomberg, HDFC TRU

The current spread between India’s 30yr and 10yr G-sec yield is significantly higher at 70 bps vs. last 23-year median spread of 44 bps.

Given the Centre’s fiscal consolidation path and other factors noted above, 30yr vs. 10yr yield spread has the potential to narrow from the current levels.

Out Take:

The current steepness of India’s yield curve is a clear outlier from its historical trend, creating a notable disconnect between market pricing and underlying fundamentals. With a pro-growth RBI having already front-loaded rate cuts, and the government maintaining strong fiscal discipline, the domestic environment is increasingly supportive of lower long-term yields. This is expected to be further reinforced by a global tailwind of potential Fed rate cuts and India’s sovereign credit rating upgrade by S&P. We believe these factors will compel a mean reversion, leading to a flatter yield curve through fall in long-duration bond yields.

It is noteworthy that the fundamental context for falling yields has evolved significantly. A year ago, this was considered a secular view as the RBI had not begun its monetary easing cycle. Today, after having front-loaded a significant 100 bps of repo rate cut and repo rate likely nearing its terminal rate, the scope for further yield compression has become more limited, positioning this as a tactical rather than a long-term secular view.

Risks to our View:

- Domestic inflation surprise could force a hawkish RBI pivot, widening the spread.

- Unexpected fiscal slippage could increase bond supply, pushing up long-term yields.

- A hawkish Fed could trigger foreign capital outflows, pressuring domestic yields.