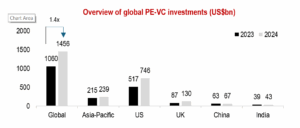

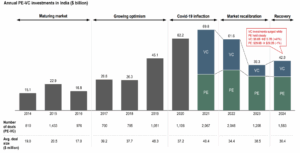

India’s PE-VC investments saw a healthy growth of approximately 9% in 2024, reaching around US$43 billion, up from US$39 billion in 2023. This growth aligns with the broader Asia-Pacific region, although it was slightly slower than global levels. India continues to be a dominant player in the Asia-Pacific funding landscape, securing its position as the second-largest destination and accounting for about 20% of total investments in the region.

Source: Bain &Company-India Private Equity Report 2025

The PE-VC market experienced some recalibration in 2024. Elevated valuations in public markets influenced private market deals, leading to extended deal processes and difficulties in reaching closures. While the overall momentum in deal volume was driven by an increase in small-ticket size deals, mid-to-large ticket deals saw a marginal decline.

Source: Bain &Company-India Private Equity Report 2025

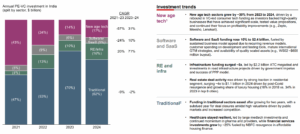

In 2024, the rebound in PE-VC investments was primarily led by the real estate and infrastructure sectors, alongside new-age technology.

Source: Bain &Company-India Private Equity Report 2025

India experienced record domestic fundraising in 2024-2025, with notable closures including Kedaara’s $1.7 billion fund and ChrysCapital’s $2.1 billion. Commitments from global and government-linked funds also increased.

Exit activity saw a significant surge of 16% year-over-year, reaching approximately $33 billion in 2024. Public market exits played a crucial role, rising to 59% of the total exit value (up from 51% in 2023), driven by IPOs and block trades. Financial services, healthcare, and consumer/retail sectors led these exits. This overall trend of robust fundraising and exits signifies a maturing and healthy PE/VC ecosystem in India.

Source: Bain &Company-India Private Equity Report 2025

HDFC Tru is the Investment Advisory arm of HDFC Securities Ltd; SEBI Registration No: INA000011538, which provides holistic Wealth Management Solutions to UHNIs, Family Office & Institutions. Please reach out to us at tru@hdfcsec.com or visit our website at www.hdfc-tru.com. You can also contact us at +91 993020394.