India's Household Debt Landscape

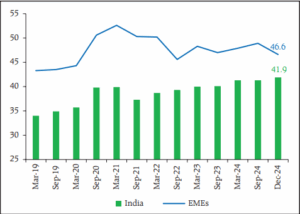

Overview of Household Debt

India’s household debt is steadily increasing, but a rising concern is its evolving purpose: a growing inclination towards consumption over traditional asset building.

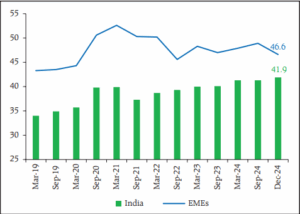

- As of end-December 2024, India’s household debt stood at 41.9% of GDP (at current market prices)

- This is relatively low compared to the average for other Emerging Market Economies, which was 46.6% for the same period.

- However, the average debt per individual borrower has jumped by 23% in just two years, from ₹9 lakh in March 2023 to ₹4.8 lakh by March 2025.

Household Debt (% of GDP)

Source:RBI Financial Stability Report, June 2025

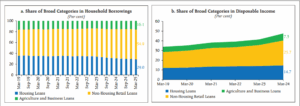

The Consumption Surge: Non-Housing Loans Dominate:

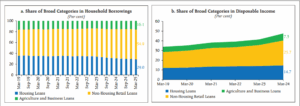

A significant shift is observed in the types of loans households are increasingly taking, with a pronounced tilt towards consumption-oriented credit.

- Non-housing retail loans (personal loans, credit cards, auto loans) now comprise a striking 54.9% of total household debt as of March 2025 and 25.7% of disposable income as of March 2024. This shows how consumption-led borrowing is consuming a larger portion of household earnings over time.

- In contrast, home loans account for just 29% of total household debt.

Source:RBI Financial Stability Report, June 2025

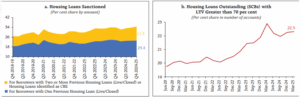

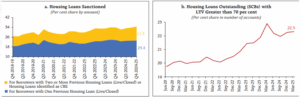

- While housing loans exhibit steady growth, disaggregated data reveals interesting trends in new sanctions and loan-to-value ratios.

- Incremental growth in housing loans is predominantly driven by existing borrowers availing additional loans, whose share increased to more than a third of housing loans sanctioned in quarter ending March 2025.

- The share of borrower accounts with Loan-to-Value (LTV) ratios greater than 70% is rising.

Source:RBI Financial Stability Report, June 2025

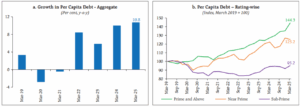

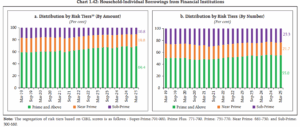

Borrower Profile & Financial Health

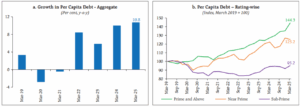

- India’s aggregate per capita debt for individual borrowers has risen significantly, from ₹3.9 lakh in March 2023 to ₹4.8 lakh by March 2025, marking a 10.8% year-on-year growth in March 2025.

- This increase is primarily fueled by “Prime and Above” borrowers, whose per capita debt (indexed to March 2019=100) reached 144.3 by March 2025.

- In contrast, per capita debt for “Sub-Prime” borrowers has declined relative to 2019 levels, standing at an index of 95.2 by March 2025.

Source:RBI Financial Stability Report, June 2025

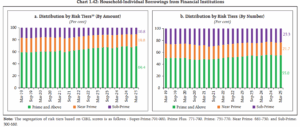

- By March 2025, 69.4% of the total outstanding borrowing amount and 55% of total number of borrowers fell into “Prime and Above” category.

- This increasing concentration of debt among better-rated customers is crucial, as it indicates stronger aggregate debt serviceability and enhanced resilience of household balance sheets from a financial stability perspective

Individual Borrowings from Financial Institutions

Source:RBI Financial Stability Report, June 2025

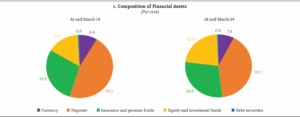

Dominance of Traditional Assets:

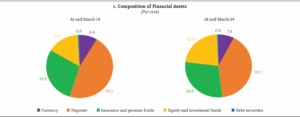

- Deposits and insurance and pension funds formed nearly 70% of household financial wealth as at end-March 2024 even as the share of equities and investment funds has increased.

- The share of Equity and Investment Funds has notably increased. It grew from 15.7% at end-March 2019 to 22.4% at end-March 2024. This signifies a growing preference or allocation towards capital market instruments.

- While Indian households continue to favor relatively safe and traditional financial assets like deposits and insurance/pension funds, there’s a clear trend towards increasing allocation to market-linked instruments (equities and investment funds), suggesting evolving investment preferences and potentially higher risk appetite or financial sophistication.

Source:RBI Financial Stability Report, June 2025

Key Takeaway

- Reserve Bank of India (RBI) views the overall risks to the Indian financial system from household lending as contained, and the easing monetary policy cycle is expected to reduce debt service pressures on borrowers.

- India’s household debt surge, driven by consumption loans for “instant gratification” rather than asset creation, demands careful monitoring, especially among lower-rated borrowers. This trend presents a critical question: is it merely cultural evolution or a warning signal for future financial stress?