India’s education sector is a dynamic and expanding market, driven by the country’s large, young population and growing economic aspirations. While facing challenges like school closures and consolidation, the sector is experiencing significant growth, particularly in higher education and supplemental learning. This overview explores the market’s key segments, financial trends, and the increasing role of online education in meeting the evolving demands of students and parents. Population less than 25 years contributes to ~44% of India’s population in CY2024. Out of them, ~54% are in school going age of 5-18 years and ~28% are in the college and university going age of 19-25 years.

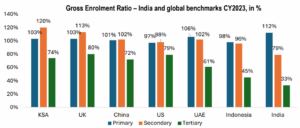

India’s consumption is projected to be driven by its young, middle-income population over the next decade. As of 2024, approximately 44% of the population is under 25, with a median age of 28 years, making it younger than major economies like China (39 years), the UK (39 years), and the US (38 years). This demographic is increasingly focusing its spending on essential investments such as education and skill development.

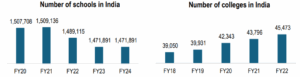

India’s education sector is one of the world’s largest. Between FY18 and FY22, the number of colleges increased from 39,050 to 45,473. However, the number of schools decreased from over 1.5 million in FY18 to about 1.47 million in FY2024, a drop attributed to pandemic-related closures and government school consolidation

Source: Physics Walla RHP.

Source: Physics Walla RHP.

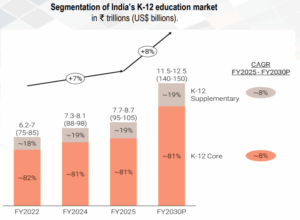

K-12 Education market: The K-12 core education market in India, currently valued at ₹6-7.0 trillion (US$ 75-85 billion), is projected to grow at an 8% CAGR to reach ₹9.5-10.5 trillion (US$ 115-125 billion) by FY30. The number of enrolments is also expected to reach 290-320 million over the same period. The supplemental education market comprises about 18% of the above. The supplemental education online segment, while currently accounting for only 11% of the market, is poised for rapid growth and is expected to increase its share to ~21% by 2030, reflecting a shift towards more flexible learning models.

Source: Physics Walla RHP.

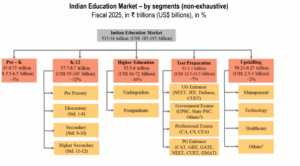

Indian education market has shown steady growth across segments, with CAGR of ~7%, ~11% and ~19% K-12, Test Preparation and Upskilling respectively between FY22 and FY25. Indian education market is primarily dominated by the K-12 and higher education segments, which constitute ~52% and ~36% of the total market respectively in FY25. As more student’s progress through K-12 and higher education, they create a base for supplementary segments such as test preparation, professional exams, and upskilling.

Source: Physics Walla RHP.

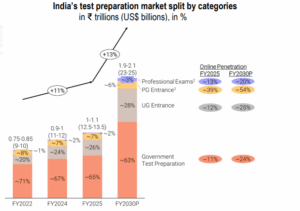

India’s test preparation market is valued at ₹1-1.1 trillion (US$ 12.5-13.5 billion) in FY2025, is projected to reach ₹1.9-2.1 trillion (US$ 23-25 billion) by FY2030, with CAGR of approximately 13%. The online test preparation segment is also expanding rapidly, projected to grow at a CAGR of 29% between FY2025 and FY2030. This will increase its share of the total market from 13% to 26%, with an estimated market size of ₹500-550 billion (US$ 6-6.5 billion).

Source: Physics Walla RHP.

| # | Legal Entity Name | Brand Name | Revenue (FY 2024) in ₹Mn |

| 1 | Allen Career Institute Pvt. Ltd. | Allen | 32,447.2 |

| 2 | Aakash Educational Services Ltd. | Aakash | 23,858.2 |

| 3 | Physicswallah Ltd. | Physics Wallah | 19,407.1 |

| 4 | Sorting Hat Technologies Pvt. Ltd. | Unacademy | 8,398.0 |

| 5 | Veranda Learning Solutions Ltd. | Veranda Learning | 3,617.3 |

Source: Physics Walla RHP.