India's Direct Tax Collections: Net Growth Hits 7% (April-Nov 2025)

The Centre has budgeted Rs 25.2 lakh crore in direct tax collections for FY26, targeting a 13.2% growth over FY25. However, direct tax collections in FY26 so far (till 10th Nov) have grown only 7% YoY to Rs 12.9 lakh crore, implying a steep ~21% growth needed in the remaining months to meet the FY26 target. This is challenging, especially with nominal GDP growth running softer than the FY26 budget estimate (8.5-9% expected vs. 10.1% budgeted for FY26). While the direct tax growth target for remainder of FY26 is demanding, healthy GST performance and prudent expenditure management provides buffer to the Centre to achieve its FY26 fiscal deficit target of 4.4% of GDP.

Net Collections Rise, Driven by Individuals and Lower Refunds

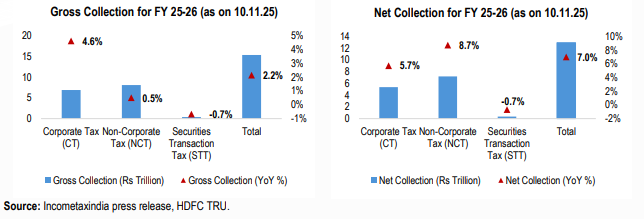

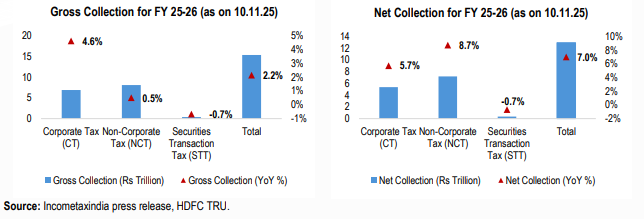

The Centre has budgeted Rs 25.2 lakh crore in direct tax collections for FY26, targeting a 13.2% growth over FY25. However, direct tax collections in FY26 so far (till 10th Nov) have grown only 7% YoY to Rs 12.9 lakh crore, implying a steep ~21% growth needed in the remaining months to meet the FY26 target. This is challenging, especially with nominal GDP growth running softer than the FY26 budget estimate (8.5-9% expected vs. 10.1% budgeted for FY26). While the direct tax growth target for remainder of FY26 is demanding, healthy GST performance and prudent expenditure management provide buffers to the Centre to achieve the FY26 fiscal target of 4.4% of GDP. Net-net, Gross Collections only saw a modest increase of ~2%, while the overall net collections growth of 7%, was heavily influenced by lower refunds.

- Gross Collection slows, net growth driven by timing: Gross direct tax mop-up increased by only 2.2% to ₹15.35 trillion, indicating a slower pace of actual tax inflow, while the higher net growth is largely a result of the reduction in the refund outgo.

- Non-Corporate Tax (Individuals & Firms) Outpaces Corporate Tax Growth: The Net NCT collection (paid by individuals, HUFs, firms, etc.) registered the highest growth at 8.7%, rising to ₹7.19 trillion and surpassing the Net Corporate Tax (CT) collection, which grew by 5.7% to ₹5.37 trillion.

- Refund reduction is primary driver of net growth: There is a sharp 17.7% drop in total refunds, which is the primary driver of the high 7% net growth. Refunds to non-corporate taxpayers specifically fell by 37.7%.

- STT collection remains flat: The Securities Transaction Tax (STT) collection was largely flat at ₹35,682 crore, showing a slight decline of 0.7%, which reflects a lacklustre performance in the equity market turnover.

- CBDT confident in meeting FY26 Direct Tax collection target: Despite a mid-year check showing net receipts (CT, PIT, and STT) have only reached 49% of the target, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal affirmed that India will meet its ₹25.2 trillion direct tax collection goal for FY26. In FY25, net direct taxes rose 13.6% YoY to ₹22.26 trillion, surpassing the Initial Budget estimate of Rs. 22.07 trillion but slightly missed the revised target of Rs. 22.37 trillion.