India's Debt Market: A New Era of Global Investment

Executive Summary:

In recent years, India’s government bond market has undergone a significant transformation, culminating in its inclusion in some of the world’s most prominent global debt indices. This watershed moment is expected to reshape foreign portfolio investment (FPI) flows into India, bringing the country’s sovereign debt closer to the global mainstream.

- JP Morgan’s Government Bond Index–Emerging Markets (GBI-EM): JP Morgan began the inclusion process for Indian government bonds in its GBI-EM indices on June 28, 2024. The inclusion was completed in Mar-25 with India’s weight at 10% (maximum possible weight for a country in the index).

- Bloomberg’s EM Local Currency Government Index: Bloomberg has also added Indian FAR (Fully Accessible Route) government bonds to its EM Local Currency Government Index in a staggered process over ten months beginning January 31, 2025. Once fully phased, India’s bonds are expected to account for up to 10% of the index, positioning India as a key emerging market alongside China and South Korea in this global benchmark.

- FTSE Russell’s Emerging Markets Government Bond Index (EMGBI): Starting Sep-25, FTSE Russell will include Indian government bonds, specifically those classified as Fully Accessible Route (FAR) eligible into its EMGBI and related Asian bond indices. The inclusion will be phased over six months, and India’s allocation is projected at around 9-10% of the EMGBI by market value, making India the second-largest component after China.

These collective developments signify a new era for India’s bond markets, underscoring the country’s increased integration into the global financial ecosystem and setting the stage for more robust foreign investor participation in Indian government debt.

Global Bond Indices Inclusion Effect:

The most prominent structural catalyst has been the announcement of India’s inclusion into the JPMorgan GBI-EM Global Index suite in June 2024.

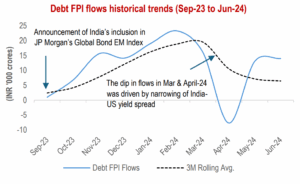

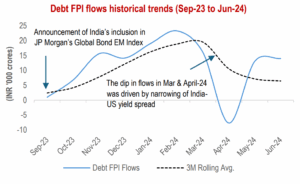

- Following the JP Morgan inclusion announcement in September 2023, the monthly Debt FPI flows into India between September 2023 (announcement month) and June 2024 (inclusion month) averaged INR 11,500 crore. Notably, debt FPI flows consistently remained above their 3-month rolling average, with the exception of March and April 2024. The dip in flows during March and April 2024 was primarily driven by narrowing of India-US yields spread amid shifting global sentiment.

Source: NSDL.

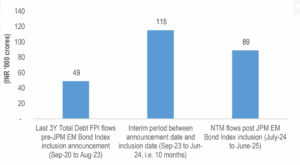

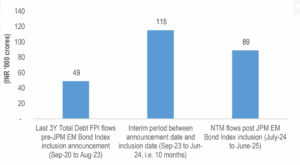

- Even more strikingly, the combined FPI monthly flows into India over the three years prior to the September 2023 JPM Bond Index inclusion announcement totalled merely INR 49,000 crore. This figure contrasts sharply with INR 204,000 crore recorded post the September 2023 inclusion announcement in the JPM EM Bond Index, reflecting an increase of over four times.

Source: NSDL.

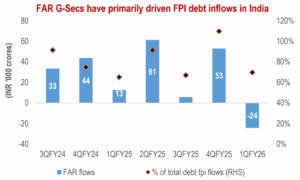

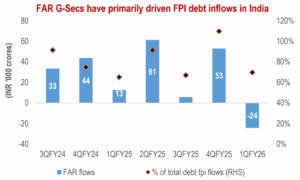

- The total debt FPI flows are broadly categorized into two types: i) Fully Accessible Route (FAR) G-Secs and ii) Corporate bonds and other G-secs. FAR securities are those without capital controls by the Reserve Bank of India (RBI), allowing FPIs to invest freely in FAR G-secs without any investment limits. Our analysis indicates that between October 2023 and June 2025, FAR G-secs constituted over 90% of the total debt FPI flows into India, thus serving as the key driver behind the resurgence in debt flows in India.

Source: CCIL.

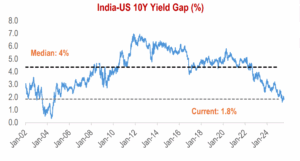

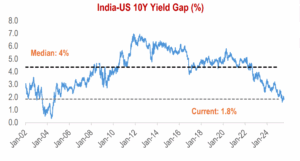

- In the prior quarter (April-June 2025), India experienced higher debt FPI outflows. This was primarily triggered by the sharply narrowing bond yield spread between India and the US, global economic and geopolitical uncertainties, and the resulting shift in global risk appetite from emerging market debt to safer Western bonds. The median 10yr government bond yield spread between India and US over last two decades was 4%, but currently it is significantly lower at 1.8%.

Source: Bloomberg, Investing.

Our Take:

- Index Inclusion Significance: The inclusion of Indian government bonds in prominent global debt indices, such as JP Morgan’s GBI-EM and Bloomberg’s EM Local Currency Government Index, marks a significant structural shift in India’s bond market.

- Post-Announcement Surge: Post-announcement of the JP Morgan inclusion in September 2023, debt FPI flows into India saw a remarkable increase, more than quadrupling compared to the preceding three years.

- FAR G-Secs a Key Driver: Fully Accessible Route (FAR) G-Secs have been the primary driver of this resurgence, constituting over 90% of total debt FPI flows between October 2023 and June 2025.

- External Headwinds: While the long-term outlook for FPI debt flows into India is positive due to these inclusions, external factors like narrowing yield spreads and global uncertainties can lead to temporary outflows.