India's Commercial Real Estate: Overview

India’s office market is poised for significant growth, driven by a strong talent pool and a sustained “Return to Office” (RTO) trend. The market’s future looks promising due to a diversified demand from sectors like Technology and BFSI, and a shift towards higher-value Global Capability Centers (GCCs). This positive outlook is further supported by projections of continued absorption exceeding supply and accelerating rental growth across key cities.

India’s office market is poised for significant growth, driven by a strong talent pool and a sustained “Return to Office” (RTO) trend. The market’s future looks promising due to a diversified demand from sectors like Technology and BFSI, and a shift towards higher-value Global Capability Centers (GCCs). This positive outlook is further supported by projections of continued absorption exceeding supply and accelerating rental growth across key cities.

Source: Knowledge Realty Trust RHP, CBRE

- The average absorption from 2022 to the first quarter of 2025 is projected at 70.5 msf (million square feet), which is a substantial jump from the 2016-2019 average of 55.1 msf. This indicates a strong rebound and increased demand for office spaces after the pandemic-related disruptions.

- The effective vacancy rate fluctuated between 14.7% and 18.0% in the pre-pandemic years (2016-2020), rising sharply to 21.1% in 2022. It then began a downward trend, projected to drop to 16.1% in CY2026. This indicates that while the pandemic initially drove up vacancy, the subsequent “Return to Office” trend has led to a significant decrease in vacant spaces.

- CBRE projects absorption to exceed supply in each year for CY 2025, CY 2026 and CY 2027, a trend that will help reduce the vacancy rate.

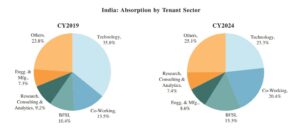

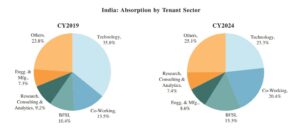

Diversification of Occupier Demand

- Demand for office space is increasingly diversified, with a shift from traditional call centers to high-value Global Capability Centers (GCCs). In FY2010, India had 700+ GCC occupiers which grew by a 6.1% CAGR to 1,800+ GCC occupiers as of February 2025 and is expected to further increase to 2,100+ GCC occupiers by FY2028. GCCs share of leasing increased from 30.1% in CY2022 to 35.8% by the end of CY2024.

- The leading sectors driving absorption are Technology (23.3%), Co-working (20.4%), and BFSI (15.3%) as of CY2024.

- A notable trend is the rising influence of domestic firms, which accounted for 46.5% of commercial leasing in CY2024, up from 30% in CY2015.

Source: Knowledge Realty Trust RHP, CBRE

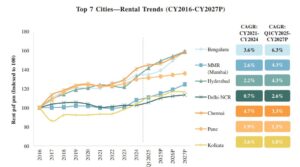

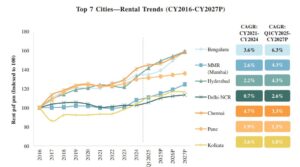

Key Office Lease Rental Trends in Major Cities

Source: Knowledge Realty Trust RHP, CBRE

- The top seven cities – Bengaluru, Mumbai (MMR), Delhi-NCR, Hyderabad, Chennai, Pune, and Kolkata – account for nearly the entire organized office market, with Bengaluru, Mumbai, and Hyderabad contributing over half of the total gross absorption.

- CBRE projects that most cities will experience faster growth in rentals over CY2025-2027. The factors influencing higher rentals are- constrained supply in prime locations coupled with robust demand from both domestic and international tenants especially within technology and BFSI sectors.

- For instance, Delhi-NCR’s lease rental CAGR is projected to increase to 2.6% over CY 2025-2027 compared to 0.7% during CY 2021-2024.

- Both Mumbai and Hyderabad also show robust and accelerating growth, with their lease rental CAGRs projected to increase to 4.3% over CY 2025-2027.