The Indian hospitality industry is booming, projected to grow from US$281.8 Bn in 2025 to US$541.7 Bn by 2030, at a 14.0% CAGR. Despite this rapid growth, it remains underpenetrated, signaling significant future potential.

Source: DRHP of Schloss Bangalore Limited

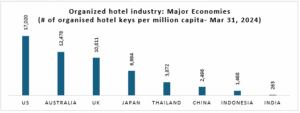

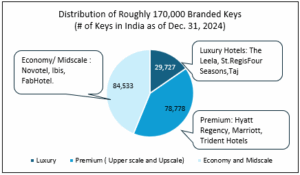

As of March 31, 2024, India’s hotel landscape boasts an estimated 3.4 million keys. Of this, the organized sector comprises only ~11% (approx. 375,000 keys), with branded hotels accounting for 45% (roughly 170,000 keys-) within this segment.

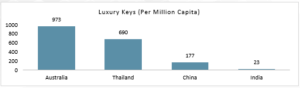

The luxury segment constitutes just 17% of branded hotel stock, approximately 29,000 luxury keys. This highlights significant under penetration compared to other major Asia-Pacific nations:

Source: DRHP of Schloss Bangalore Limited

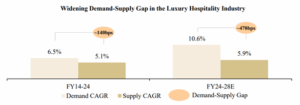

A favorable demand-supply outlook is expected for the luxury hospitality segment in India, with total demand estimated to grow at a CAGR of 10.6% over FY24-28 against supply CAGR of 5.9% over the same period.

Source: DRHP of Schloss Bangalore Limited

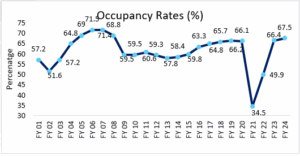

India’s branded hotel sector achieved a 67.5% nationwide occupancy rate in 2023-2024, the highest in a decade, with an average daily rate of Rs 8,055. Mumbai, New Delhi, and Hyderabad had the highest occupancy rates.

Source: DRHP of Schloss Bangalore Limited

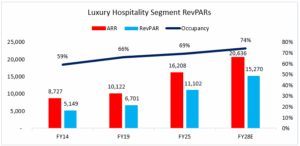

Average Room Rent (ARR) is room revenue divided by room nights sold. ARR for the luxury hospitality segment grew at 5.7% CAGR over Financial Year 2014 to Financial Year 2024, compared to the India hospitality industry that grew only 3.1% CAGR over the same period.

Revenue Per Available Room (RevPAR) combines pricing and occupancy (ARR x occupancy). In FY24, the RevPAR for the luxury hospitality segment was ₹10,122, nearly 2.1 times the overall hospitality industry, which stood at ₹4,739. As per the DRHP of Schloss India, luxury hospitality segment RevPARs is expected to grow 1.5 times between FY2024-28E.

Global Experience: Luxury hotels grew sharply in the US (Marriott) and Europe (Accor hotels) when their economies grew from US$3.6 bn to US$7.2 bn.

Source: DRHP of Schloss Bangalore Limited

HDFC Tru is the Investment Advisory arm of HDFC Securities Ltd; SEBI Registration No: INA000011538.

Website: www.hdfc-tru.com, Email: tru@hdfcsec.com, Phone: +91 993020394