Indian Jewellery Sector: Overview, Growth Drivers and Key Trends

The Indian jewellery market grew at a CAGR of 13%-15% between 2021 and 2024. This growth was significantly higher than that of China (2%-4% CAGR) and the USA (1%-2% CAGR) for the same period. The Indian jewellery market is projected to reach $130-$140 bn by 2029. A key driver of this expansion is the shift from unorganized to organized retail, with the organized sector’s share projected to reach 43-47% by 2029 (vs. 37% in 2024). The branded jewellery segment is also growing strongly, accounting for about 35% of the total market and is expected to reach $58-$60bn by 2029.

India’s Jewellery market poised for strong growth…

- The Indian jewellery market has grown steadily at a CAGR of 13%-15% between 2021-2024 and currently stood at ~US$75bn.

- The growth rate of India has been significantly higher than China (CAGR of 2%-4%) and the USA (CAGR of 1%-2%) between 2021-24 due to its favourable demographics.

- The jewellery market in India is projected to reach US$130-140bn by 2029, growing at a CAGR of 12%-14% between 2024-29.

| Country |

Market Size (INR bn) |

2021-2024 (CAGR) |

2024-2029P (CAGR) |

| India |

6,340 |

13-15% |

12-14% |

| China |

10,400 |

2-4% |

4-6% |

| USA |

6,100 |

1-2% |

2-4% |

Source: Redseer Research & Analysis, Bluestone RHP.

Growth in India’s Retail Market will be led by discretionary categories (especially Jewellery)…

- While grocery (largely non-discretionary) holds the largest share of the overall domestic retail ecosystem at >60% in 2024, discretionary categories like electronics, jewellery, and fashion are expanding rapidly.

- This is predominantly driven by rising consumption, income levels, and demand from Tier 3+ markets, alongside increasing influence from social media and the need for personalized shopping experiences.

| Categories |

2019-2024 (CAGR) |

2024-2029P (CAGR) |

| Grocery |

4% |

7-9% |

| Jewellery |

6% |

12-14% |

| Fashion |

6% |

10-12% |

| Electronic Appliances |

17% |

12-14% |

| Beauty and personal care |

6% |

9-11% |

| Others |

11% |

8-11% |

Source: Redseer Research & Analysis, Bluestone RHP. Note: Others includes mobiles, pharma, alcohol and tobacco, general merchandise, eyewear, furniture, etc.

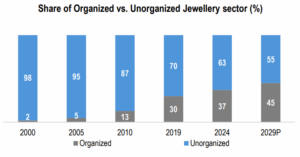

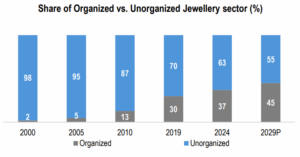

Shift from Unorganized to Organized Retail in India – A Key Structural Growth Driver:

- The organized retail sector’s share in the Indian jewellery market is on a fast-growing trajectory. It has increased from just 2% in 2000 to roughly 37% in 2024.

- This segment is projected to grow to 43%-47% of the total market by 2029, with a CAGR of 16%-18%.

Source: Bluestone RHP.

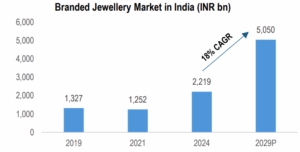

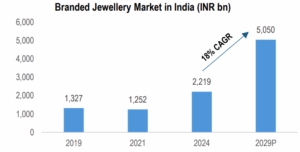

Branded Jewellery segment seeing strong traction in India…

- The popularity of branded jewellery in India is on the rise, signaling a more mature market where consumers value trust, quality, and design as much as the intrinsic worth of the materials. From 2019 to 2024, the branded jewellery market grew from about $16bn to $26 bn.

- As a result, branded jewellery now makes up ~35% of the total Indian jewellery market. This trend is driven by consumers who are increasingly seeking better designs, higher quality, and transparent pricing.

- The branded market is projected to continue its strong growth, potentially reaching $58-60bn by 2029, accounting for 43-45% of the overall market.

Source: Bluestone RHP.

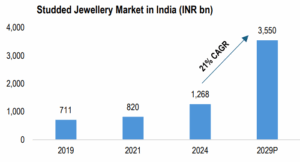

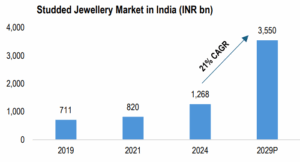

The Studded Jewellery Market in India is also gaining higher prominence…

- The studded jewellery market has an estimated market share of 15%-25% of the overall jewellery market.

- India has experienced a significant increase in demand for studded jewellery in recent years, growing at a CAGR of ~16%, largely influenced by consumers shifting preferences in line with global trends.

Source: Bluestone RHP.