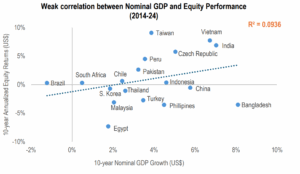

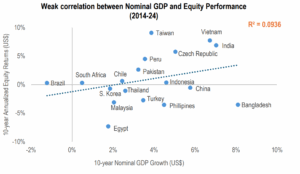

Higher GDP growth leads to higher Equity returns, right? Right?

Despite the common belief, higher nominal GDP growth does not automatically translate into superior equity returns, particularly in emerging markets. History shows very little to no correlation. China’s rapid growth often delivered weak equity outcomes, while countries like Taiwan generated stellar returns on modest growth. The disconnect arises from factors like capital dilution, governance challenges, lack of breadth in stock markets, and currency / economic policy risks. For investors, the real drivers of long-term equity performance remain earnings growth, return on equity, capital discipline and not headline GDP numbers.

The Misconception:

A widely held belief in emerging market investing is that higher GDP growth translates into higher equity returns. The logic appears intuitive: faster economic growth should mean stronger corporate profits and, in turn, superior market performance. However, history and research suggest otherwise.

The Evidence:

Our analysis shows weak correlation between Nominal GDP growth and Equity returns: While some countries have strong returns coupled with a higher GDP growth profile, there are several countries where low GDP growth markets also delivered higher returns. Examples reinforce the point:

- China:Nearly 6% Nominal GDP growth (US$) in the last 10 years, yet volatile and often disappointing equity returns.

- Taiwan: Slightly lower Nominal GDP growth (c.4% in US$) but delivered the highest equity returns (~9% US$), within the Emerging Market basket.

- India and Vietnam: Only exceptions with strong nominal GDP growth as well as robust equity market outcomes.

Source: Bloomberg, IMF, HDFC TRU.

Empirical studies across markets have consistently found little to no correlation.

- MSCI (1998–2020): A cross-country analysis of nominal GDP growth vs. equity market returns revealed no consistent relationship (here).

- Vanguard (1900–2009): A century of data across 16 major markets showed that the long-term correlation between GDP per capita growth and equity returns was effectively zero (R² = 0.04) (here).

Why the Disconnect?

- Corporate governance Issues: Poor governance standards can lead to lack of transparency, weaker protections for minority shareholders, and a higher risk of corruption, all of which deter foreign investment and depress valuations.

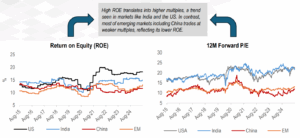

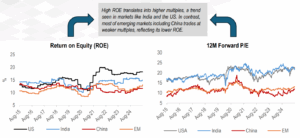

- Weak Return on Equity (ROE) and Capital dilution: Growth without capital discipline undermines shareholder returns. High-growth economies often raise equity aggressively, diluting EPS despite GDP growth.

- Currency & Policy Risks. FX depreciation, inflation, and regulation risks frequently erode equity gains.

For instance, the US equity markets registered a nominal GDP growth of ~5% in the last 10 years, but delivered equity returns (S&P 500) of ~11%, significantly outperforming some of the other major global markets (such as China, Japan, Europe). This was predominantly driven by consistent uplift in ROE and robust EPS growth, resulting in re-rating of US valuation multiples vs. other global markets.

Source: Bloomberg, HDFC TRU. Note: Priced as on 21 Aug, 2025.

Our View:

- Nominal GDP growth is not a predictor of equity returns. In emerging markets, especially, the gap between economic growth and shareholder wealth creation is particularly wide.

- Investment success hinges on EPS growth, ROE, valuations, and governance, not macro growth rates.

- Global asset allocation must focus on earnings resilience, capital efficiency, and shareholder returns rather than chasing high-growth economies.