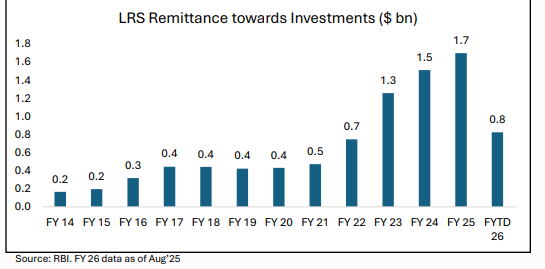

Global investing offers Indian investors a gateway to diversify portfolios and tap into international growth. Under LRS, individuals can remit up to $250,000 annually, with overseas investments in equities and debt rising sharply to $1.7 billion in FY25. Alongside, corporates use ODI for strategic control and OPI for passive exposure. These regulated routes provide opportunities to enhance returns and reduce domestic concentration risk, making global allocation a key pillar of modern wealth planning

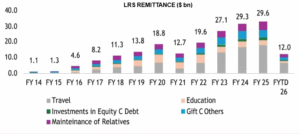

Introduced in 2004, LRS allows Indian residents to remit up to $250,000 p.a. overseas for purposes such as education, travel, investments and real estate. Over the past decade, remittances under LRS have grown from $1.1 bn in FY 14 to $29.6 bn in FY 25

As can be seen in the table above, travel alone accounted for more than 57% of the outgo in FY 25, while investments in equities & debt accounted for 5.7% share. In absolute terms, investments in equities and debt under the LRS have grown 8.5 times over the last decade, rising from $0.2 billion in FY14 to $1.7 billion in FY25. On a monthly basis, the average for FY25 stands at approximately $141.7 million

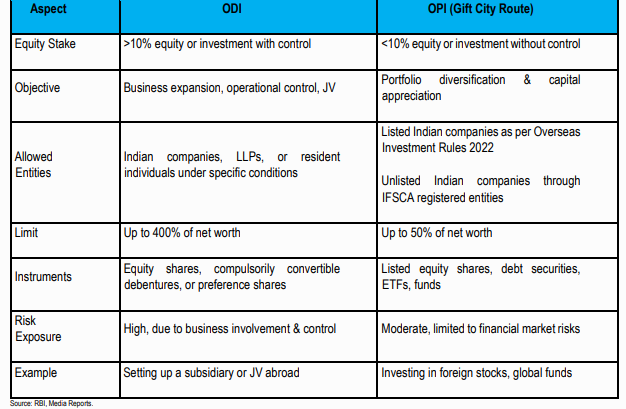

Corporates and non-individual investors in India can invest in foreign securities primarily through the ODI and OPI

frameworks, regulated by the RBI under the Foreign Exchange Management Act (FEMA).