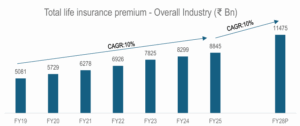

The Indian life insurance sector stands as a remarkable story of growth and resilience, mirroring the nation’s economic development. Once a modest industry, it has transformed into a vibrant, rapidly expanding market fueled by a burgeoning middle class, increasing financial awareness, and supportive regulatory reforms. From its roots, the industry has demonstrated an impressive upward trajectory, achieved double-digit growth rates and established itself as a crucial pillar of the Indian financial landscape, playing a vital role in providing financial security to millions of households.

India Life Insurance in India since its beginning in the 1800s has undergone significant transformations. Post independence, Indian government nationalized the life insurance industry in India by establishing the Life Insurance Corporation of India (LIC). LIC became the sole provider of life insurance in India, thus playing an important role in popularizing life insurance products. The Insurance Regulatory and Development Authority (IRDA) Act of 1999 and Insurance Act of 1938 provided legal framework to the nascent life insurance industry in India.

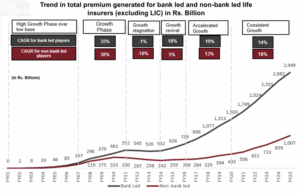

In 1999, the liberalization of the Indian economy introduced private life insurance companies in the market. The process of opening the sector to private players had begun in early 1990. In 1993, committee under the chairmanship of R N Malhotra recommended private players to enter the insurance market. The committee also recommended that foreign players be allowed to enter Indian insurance market preferably through joint ventures. ICICI Prudential Life Insurance and HDFC Life Insurance established in 2000 were the first private life insurance company to start their operations post liberalization.

As of June 30, 2025, there were 25 private sector life insurance companies and one public sector life insurance company, i.e., LIC are registered with IRDAI.

Source: Canara HSBC Life insurance RHP

Source: Canara HSBC Life insurance RHP.

Source: Canara HSBC Life insurance RHP.