Are aggressive duration bets worth it, or does patience pay more? Unlock the truth behind duration calls in Indian debt mutual funds! This note dives deep into a decade of gilt fund strategies, revealing how most fund managers react, not predict, interest rate cycles. Passive constant maturity funds have quietly outshone most active managers, delivering superior returns. Insightful reading for investors seeking to separate market timing myths from hard results.

Introduction

Duration management is a critical lever for generating alpha in debt mutual funds, as interest rate movements significantly impact bond prices. Fund managers often take active duration calls to benefit from anticipated rate cycles, aiming to enhance returns beyond accrual income. However, the effectiveness of these calls remains debated, given the unpredictability of macroeconomic factors and rate actions. This note examines whether debt fund managers in India have been successful in executing duration strategies and delivering superior outcomes for investors.

Duration Positioning vs. Interest Rates: A 10-Year Perspective

For our analysis, we have chosen gilt fund category as it allows the fund managers to take exposure across the entire government securities curve without any credit risk. Unlike dynamic bond funds, which can allocate to non-sovereign securities (or in other words take some credit risk), gilt funds provide a pure play on interest rate movements through duration management.

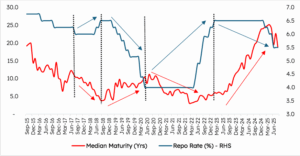

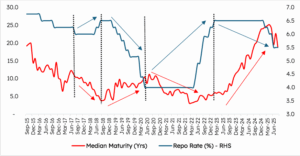

The chart below maps the median portfolio maturity of gilt funds against the RBI repo rate over the last decade. This comparison illustrates how fund managers have adjusted duration in response to monetary policy cycles and whether these adjustments align with rate movements.

Median Portfolio Maturity vs. Repo Rate

Source: ACEMF, RBI, Bloomberg; HDFC TRU

- Median portfolio maturity consistently drops when the repo rate rises, showing managers actively reduce duration in anticipation of higher rates and mark-to-market losses.

- Following periods of repo rate stability or cuts, managers gradually extend portfolio maturities; this highlights a strategic risk-on stance to benefit from falling yields.

- Duration often lags repo rate inflection points rather than leading them, suggesting managers predominantly react to, rather than forecast, policy changes.

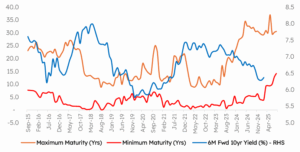

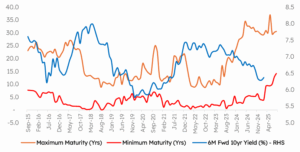

Median Portfolio Maturity vs. India’s 10yr G-sec yield (6M Forward)

Source: ACEMF, RBI, Bloomberg, HDFC TRU; Note – 6M Forward yield is actual yield 6 months ahead

- The relationship between median maturity and forward 10yr G-sec yield is not perfect. There are instances where manager action lags or is out of sync with subsequent yield moves. This highlights both the inherent difficulty of rate prediction and the diversity in fund manager approaches.

- Where the red line (median maturity) rises before or during periods when the blue line (future 10yr yield) falls, fund managers successfully anticipated falling yields and positioned portfolios for duration gains.

- There are stretches (highlighted in green boxes) where median maturity increases or remains flat but future yields rise instead of fall, indicating managers took on higher duration but were ultimately penalized by rising rates, reflecting mistimed duration extension. Similarly, there have been periods where median maturity decreases but future yields fall, limiting the capital gains.

- Rapid reductions in median maturity often precede or coincide with periods of future yield surges, showing managers’ attempts to limit mark-to-market losses by cutting risk in advance or as the uptrend in yields begins.

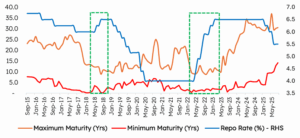

Range of Duration Calls: Max vs. Min Maturities in Gilt Funds

To understand the extent of active duration positioning, we plotted the maximum and minimum portfolio maturities within the gilt fund category over time. Unlike a single median figure, this range highlights the dispersion of strategies – from the most aggressive duration stances to the most defensive ones – taken by fund managers during different interest rate cycles. Observing this spread helps assess whether managers exhibit conviction, cluster around similar positions, or diverge significantly when policy signals are uncertain.

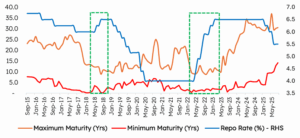

Portfolio Maturity Dispersion vs. Repo Rate

Source: ACEMF, RBI, Bloomberg, HDFC TRU

- Minimum maturity stays within a range across all periods, showing that some managers are consistently conservative regardless of policy shifts. On the other hand, changes in maximum maturity are more pronounced, especially during rate cuts or periods of high uncertainty, suggesting that a few managers actively take duration calls for capital gains.

- When repo rate rises steeply, the difference between maximum and minimum maturities contracts (refer green box in above chart), reflecting reduced conviction and risk appetite among managers – most move to defensive short duration strategies.

- During periods when repo rates are stable or declining, the gap between maximum and minimum maturities increases, reflecting managers’ diverse market views and varying willingness to take interest rate risk.

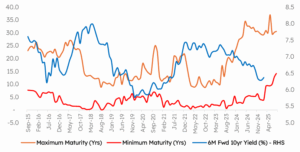

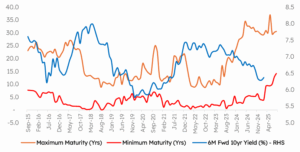

Portfolio Maturity Dispersion vs. India’s 10yr G-sec yield (6M Forward)

Source: ACEMF, RBI, Bloomberg, HDFC TRU; Note – 6M Forward yield is actual yield 6 months ahead

- During periods preceding a sharp increase in the 10-year yield (such as 2017-2018 and 2021-2022 spike), the band between maximum and minimum maturities narrows – indicating a consensus among managers to cut duration in anticipation (or early response) to higher yields and rising risk.

- When yields are stable or trending lower, dispersion expands. This shows managers adopting a range of duration strategies, with some extending maturities aggressively in search of capital gains and others remaining defensive, reflecting mixed views on policy and macro signals.

- Spikes and crashes in the max-min gap often precede or coincide with turning points in the forward yield, giving an early indication of shifts in consensus and rising uncertainty or risk aversion within the fund manager community.

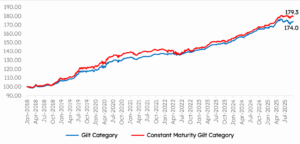

Performance Comparison: Gilt Funds vs. Constant Maturity Gilt Funds

To quantify the efficacy of duration calls by debt fund managers, we analysed the return performance of gilt funds and constant maturity gilt funds category. According to SEBI’s norms, both gilt funds and constant maturity gilt funds are required to invest a minimum of 80% of their assets in government securities. The key distinction lies in their duration mandates.

Gilt funds may invest across a broad range of maturities and typically reflect active management, with fund managers adjusting portfolio duration dynamically to navigate interest rate cycles. Conversely, constant maturity gilt funds maintain a near-passive approach by adhering to a fixed average portfolio maturity of around 10 years. Our analysis focuses on the post-2017# period to capture the uniform regulatory definitions and gain comparability of fund behaviours.

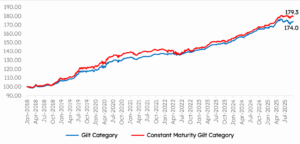

Cumulative performance: Gilt vs. Constant Maturity Gilt Funds (Jan 2018 – Sep 2025)

Source: ACEMF, HDFC TRU; Note – Average of all the funds within each category has been considered (Direct Plan)

# “Categorization and Rationalization of Mutual Fund Schemes” by SEBI in Oct 2017 led to standardisation of scheme categories and characteristics of each category across mutual funds.

Performance Comparison (Jan 2018 – Sep 2025)

| Category Returns |

Gilt Fund (A) |

Constant Maturity Gilt Fund (B) |

Difference (B-A) |

| Average CAGR |

7.4% |

7.8% |

0.4% |

| Average Absolute |

74.0% |

79.3% |

5.4% |

| Median CAGR |

7.4% |

8.1% |

0.7% |

| Median Absolute |

73.8% |

82.5% |

8.6% |

Source: ACEMF, HDFC TRU; Note – Performance is shown for Direct Plan

As can be seen in the table above, Constant Maturity Gilt Funds have outperformed Gilt Funds during Jan 2018-Sep 2025.

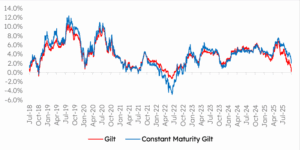

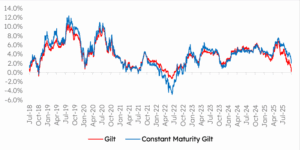

6M Rolling Return: Gilt vs. Constant Maturity Gilt Funds (Jan 2018 – Sep 2025)

Source: ACEMF, HDFC TRU; Note – Performance is shown for direct plan; Rolling returns computed daily

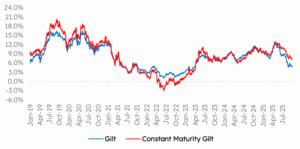

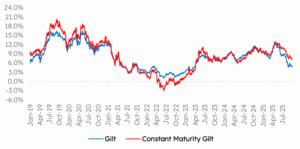

1Yr Rolling Return: Gilt vs. Constant Maturity Gilt Funds (Jan 2018 – Sep 2025)

Source: ACEMF, HDFC TRU; Note – Performance is shown for direct plan; Rolling returns computed daily

Key Conclusions:

- Constant maturity gilt funds have outperformed actively managed gilt funds, indicating that passive duration strategies have delivered better investor outcomes over the last 8-9 years (since the SEBI’s categorization and rationalization of mutual fund schemes).

- Most debt fund managers adjust duration reactively after rate cycle inflection points, rather than consistently predicting them ahead of time.

- Aggressive duration calls by managers sometimes fail to anticipate actual yield movements, resulting in mistimed risk exposure and missed capital gains.

- The dispersion in duration positioning widens during periods of policy easing, but contracts sharply in rate hike cycles, showing consensus risk aversion among managers.

- Overall, active duration management has struggled to generate excess returns, and tracking RBI signals alone has proven insufficient; disciplined passive positioning has yielded more reliable results for investors.

- Fund managers generally prioritize risk management and capital preservation, which leads them to avoid aggressive duration calls. Additionally, the need to protect returns for incoming investors and the open-ended nature of mutual funds, with ongoing redemptions, may constrain managers, contributing to relative underperformance compared to passive strategies.