Crypto investing in India is facing a dual reality: growing enthusiasm, especially among youth and wealthy institutions, juxtaposed with a complex regulatory and tax landscape. While globally recognized as an emerging asset class, India maintains a cautious stance, prioritizing risk mitigation. India’s stringent tax framework, including a 30% flat tax rate (plus applicable surcharge and 4% cess) and 1% TDS on Virtual Digital Assets (VDAs), is perceived as restrictive. Despite Bitcoin’s historical outperformance against traditional assets (such as equities, gold), significant systemic risks like custody issues and cyber threats persist. The Indian government has focused on integrating VDAs into the country’s financial oversight mechanisms through its tax regime / anti-money laundering regulations, while also exploring its own Central Bank Digital Currency (CBDC).

Globally, crypto investing has matured from an experimental pursuit into an emerging asset class attracting attention from retail investors, institutional allocators, and sovereign regulators alike. Over $4trn in market capitalization is now spread across thousands of digital assets, led by Bitcoin and Ethereum. Institutional participation has accelerated following the launch of regulated Bitcoin spot ETFs in the U.S., approved by the SEC in 2024, with firms like BlackRock, Fidelity, and Ark Invest entering the fray. Countries such as Switzerland, Singapore, and the UAE have built progressive, crypto-friendly regulatory frameworks, fostering innovation while enforcing investor protection. Meanwhile, mainstream financial institutions are exploring blockchain use cases in payments, tokenized securities, and settlement systems. Despite this progress, the landscape remains fragmented, with inconsistent tax rules, patchy oversight, and varying investor rights across jurisdictions. For global investors, crypto now represents both a frontier of innovation and a complex arena requiring robust governance, compliance, and risk discipline. However, in India, this rise has been met with a complex interplay of enthusiasm, taxation, regulatory ambiguity, and systemic risk.

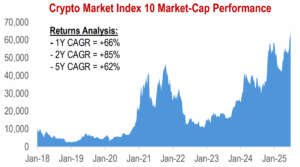

Source: Bloomberg. Note: (1) Crypto Market Index 10 measures the market cap-weighted performance of up to the 10 largest crypto assets and is quarterly rebalanced; (2) Data Period: Jan’18 to July’25.

This deep-dive note presents a comprehensive examination of crypto investing in India from the perspective of portfolio construction, taxation, custody, and regulatory compliance. It outlines how Indian investors are accessing digital assets, the implications of India’s stringent 30% tax (plus applicable surcharge and 4% cess) and 1% TDS framework, and how these instruments compare to more traditional, regulated asset classes like equities.

We explore:

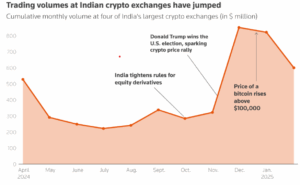

Domestic Exchanges such as CoinDCX, CoinSwitch, Mudrex, and ZebPay have seen a massive surge in Indian family office participation in recent days with many gravitating towards towards long-standing blue-chip tokens such as Bitcoin and Ethereum. Between January and June, CoinDCX observed that nearly 50% of its total trading volumes were driven by over 3,500 High-Net-Worth Individuals (HNIs), family offices, and institutions. These entities had an average investment of over INR 50 lakh in monthly trading volume specifically on spot markets. Moreover, CoinDCX saw average per trade sizes of HNIs, which was about Rs 5 lakh per trade in June, increase by nearly 25-30% in July.

Source: Reuters, CoinGecko. Note: Data includes volumes for CoinDCX, Bitbns, Mudrex and ZebPay.

While interest in digital assets continues to rise, investment avenues in India remain narrow, fragmented, and high-risk, requiring careful due diligence and tax-aware execution.

Despite regulatory ambiguity, India has witnessed growing interest in crypto assets. Access to crypto investments is available through a mix of domestic and offshore platforms, albeit within a highly constrained regulatory environment.

| Feature/Aspect | Domestic Platforms | Offshore Platforms |

| Key Exchanges (Examples) | CoinDCX, ZebPay, Mudrex. | Binance, Bybit, Coinbase. |

| Legal Status in India | Legally allowed to operate if compliant with FIU-IND registration and AML/KYC. | Can legally operate if they register with FIU-IND and comply with PMLA obligations, including a penalty if operating without prior compliance. Some have faced scrutiny and blocks for non-compliance. |

| Ease of Fund Transfer (INR) | Direct INR deposits and withdrawals are usually straightforward via various Indian payment methods (UPI, Net Banking, etc.). | Direct bank transfers from Indian bank accounts to offshore crypto exchanges for the purpose of buying crypto are not straightforward and often discouraged or blocked by banks due to regulatory uncertainties and lack of explicit permissible purpose codes. |

| FIU-IND Registration | Required: Registered with the Financial Intelligence Unit (FIU) under the Prevention of Money Laundering Act (PMLA). | Required: Subject to oversight under anti-money laundering rules and required to register with FIU-IND under PMLA. |

| KYC & AML Norms | Adhere to basic KYC (Know Your Customer) and AML (Anti-Money Laundering) norms. | Subject to AML rules and required to comply with Indian KYC/AML rules. |

| SEBI / RBI Regulation | Remain outside the purview of SEBI (Securities and Exchange Board of India) or RBI (Reserve Bank of India) regulation, as of current information. | Despite the absence of formal, crypto-specific regulation, they must comply with FIU-IND for AML purposes. They are not directly regulated by SEBI or RBI in the same way traditional financial entities are. |

| Taxation in India | – Flat 30% tax (plus applicable surcharge and 4% cess) on gains from VDA transfers (selling, swapping, spending).

– No deductions allowed except cost of acquisition. Losses from crypto cannot be offset against other income or carried forward. – 1% TDS on VDA transactions exceeding ₹10,000 (or ₹50,000 for specified persons). This is automatically deducted by the Indian exchange. |

– Same flat 30% tax (plus applicable surcharge and 4% cess) on gains from VDA transfers. Indian users are responsible for self-declaring and paying taxes on profits earned on offshore platforms.

– The 1% TDS rule applies even to transactions on offshore platforms if the income is taxable in India. However, offshore platforms typically do not deduct TDS, placing the onus on the Indian investor to ensure compliance. |

| Crypto ETFs | Remains unavailable in India from domestic AMCs due to regulatory prohibitions. | Global crypto ETFs by leading multi-national AMCs like Blackrock, Fidelity, etc. are showcased to Indian investors through brokers (such as Vested, Interactive Brokers, etc.). But we note that investing in global crypto ETFs is a complex issue with evolving regulations and more regulatory clarity needed on investment eligibility / tax regime. |

| Name | Price (US$) |

Circulating supply (mn) | Market Cap (US$ bn) |

| Tether (USDT) | 1.0 | 162 | 162 |

| Ethereum (ETH) | 3,761 | 121 | 454 |

| Bitcoin (BTC) | 117,388 | 19.9 | 2,336 |

| Solana (SOL) | 196 | 538 | 105 |

| Dogecoin (DOGE) | 0.27 | 150 | 41 |

Source: CoinGecko, Investing. Note: Priced as on 21 July 2025.

India’s overall stance related to crypto-currencies remains cautious, with a focus on mitigating risks related to money laundering, terror financing, and financial stability, while also acknowledging the potential of blockchain technology.

| Year / Date | Key Milestone / Regulatory Evolution | Impact / Significance |

| Dec-13 | RBI Issues First Cautionary Press Release: The Reserve Bank of India (RBI) issues its first warning to users, holders, and traders of Virtual Currencies (VCs) about potential financial, operational, legal, and security risks. | Marked the initial cautious stance of the central bank. |

| Feb-18 | Finance Minister’s Statement (Budget Speech): Then Finance Minister Arun Jaitley states that the government does not consider cryptocurrencies as legal tender and will take steps to eliminate their use in illegitimate activities. | Signaled the government’s negative view on crypto as currency, but also acknowledged the underlying blockchain technology. |

| Apr-18 | RBI “Banking Ban” Circular: RBI issues a circular prohibiting all regulated entities (banks, NBFCs, etc.) from dealing in VCs or providing services to facilitate crypto transactions. | Led to a significant disruption of crypto businesses in India as exchanges struggled to operate without banking services. Many exchanges either shut down or moved operations offshore. |

| Mar-20 | Supreme Court Overturns RBI Ban (IAMAI v. RBI): The Supreme Court of India sets aside the RBI’s 2018 circular, citing it as disproportionate and unconstitutional. | Provided a major relief to the crypto industry, leading to a resurgence in trading activities and the re-establishment of several Indian crypto exchanges. It established that crypto trading was not illegal in India. |

| Apr-21 | Ministry of Corporate Affairs Amends Companies Act: Requires companies dealing in Virtual Currencies (VCs) to disclose their crypto holdings, profit/loss on transactions, and deposits/advances for crypto trading in financial statements. | Brought greater transparency to corporate involvement in crypto and aimed to track crypto exposure of companies. |

| Nov-21 | “Cryptocurrency and Regulation of Official Digital Currency Bill, 2021” Listed: A bill aiming to ban all private cryptocurrencies while allowing for an official digital currency (CBDC) is listed for introduction in Parliament. | Created significant uncertainty and fear of a blanket ban, leading to a market downturn in India. The bill, however, did not pass. |

| Feb-22 | Union Budget 2022 – Taxation of Virtual Digital Assets (VDAs): Finance Minister Nirmala Sitharaman announces a flat 30% tax on income from the transfer of any Virtual Digital Asset (VDA). Also, 1% Tax Deducted at Source (TDS) introduced on crypto transactions above a certain threshold. | This was a significant step as it implicitly recognized cryptocurrencies as “assets” for taxation purposes, even if not as legal tender. It formalized the taxation framework for crypto gains and transactions. |

| Mar-22 | Finance Bill 2022 Amends Income Tax Act: Section 115BBH is inserted, codifying the 30% tax on VDA income. Section 2 of the Act is amended to define “Virtual Digital Assets.” | Legally enshrined the new crypto tax regime. |

| Oct-Dec’22 | RBI Launches CBDC Pilot (e₹-W and e₹-R): RBI initiates pilot programs for its Central Bank Digital Currency (CBDC) for wholesale (e₹-W) and retail (e₹-R) use. | Demonstrated India’s focus on its own digital currency while maintaining a cautious stance on private cryptocurrencies. |

| Mar-23 | Prevention of Money Laundering Act (PMLA) Extended to VDAs: The Ministry of Finance brings activities related to VDAs (exchange, transfer, safekeeping) under the purview of the PMLA. | Mandated crypto businesses to comply with stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) norms and register with the Financial Intelligence Unit – India (FIU-IND). This significantly tightened compliance requirements. |

| Dec-23 | FIU-IND Issues Show Cause Notices to Offshore VDA Service Providers: FIU-IND issues notices to several offshore crypto exchanges for non-compliance with PMLA. | Reinforced India’s stance on enforcing AML/KYC regulations even for international platforms serving Indian users. |

| Feb-25 | Income Tax Act, 1961, Amended (Finance Bill, 2025): Section 285BAA mandates reporting of crypto transactions by a reporting entity, with effect from 1 April, 2026. | Further strengthens the tax compliance framework and enhances the government’s ability to track crypto transactions. |

India has implemented one of the most punitive tax frameworks globally for Virtual Digital Assets (VDAs) under the Income Tax Act. This framework aims to bring transactions involving these digital assets into the formal tax net and address concerns regarding money laundering and speculative trading.

| Aspect | Tax Rate / Rule | Details |

|---|---|---|

| Tax on Income from Transfer of VDAs | Flat 30% + Surcharge + 4% Cess | Applies to all gains from selling, trading, or spending VDAs. No distinction between short-term or long-term gains. |

| Deductions Allowed | Only Cost of Acquisition | No other expenses (e.g., electricity for mining, internet charges, trading fees) are deductible. |

| Loss Treatment | No Set-off, No Carry Forward | Losses from VDAs cannot be offset against any other income or carried forward to future years. |

| TDS on VDA Sale (Sec. 194S) | 1% of Sale Consideration | Applicable if transaction value exceeds ₹10,000 (or ₹50,000 for specified persons) during the FY. |

| Crypto Gifts | Taxable at recipient’s slab rate if value > ₹50,000 | Exempt if received from specified relatives or on specific occasions. |

This comprehensive tax regime, while establishing clarity, has been perceived by many in the Indian crypto community as restrictive, potentially hindering innovation and driving some trading activities to offshore platforms. However, it signifies the government’s intent to monitor and integrate the VDA ecosystem into the country’s financial oversight mechanisms.

Systemic Risks in Crypto Investing:

While innovation is laudable, crypto as an asset class introduces multiple dimensions of risk beyond traditional investing. Systemic risk refers to the risk of collapse of an entire financial system or market, as opposed to the collapse of a single entity.

While the crypto market is still relatively small compared to traditional financial systems, its interconnectedness and unique characteristics introduce several systemic risks:

Notable Global Crypto Heists:

| Cybersecurity breaches at WazirX / CoinDCX resulted in many Indian users experiencing losses or concerns over the safety of their holdings on these platforms. |

| Year | Entity Hacked | Value Stolen (Approx. US$ at time of attack) |

| 2014 | Mt. Gox | $460 million (850,000 BTC) |

| 2018 | Coincheck | $534 million (NEM tokens) |

| 2021 | Poly Network | $610 million (Various tokens) |

| 2022 | Ronin Network | $615 million (ETH & USDC) |

| 2022 | FTX | $477 million (Various tokens) |

| 2024 | DMM Bitcoin | $305 million (BTC) |

| 2024 | WazirX | $230 million |

| 2025 | Bybit | $1.5 billion (ETH) |

| 2025 | Coinbase (Estimated) | $180 – $400 million |

| 2025 | CoinDCX | $44 million |

Note: The value stolen is an approximate figure at the time of the attack.

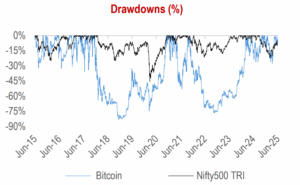

Comparative Analysis: Crypto vs. Equities

| Attribute | Cryptocurrencies | Equities |

| Regulation | Emerging, fragmented | Mature, SEBI-regulated |

| Intrinsic Value | Largely speculative | Tied to cash flows, business fundamentals |

| Liquidity | 24×7 markets | 9:15 AM – 3:30 PM (India) |

| Transparency | Pseudonymous, limited disclosures | Full audited reporting |

| Tax Treatment | 30%, no offset | 12.5% / 20%, with offset and carry forward |

| Custody | Investor’s responsibility | Depositories (NSDL/CDSL) |

| Historical Returns (CAGR) | BTC: 82% 10Y CAGR (Jun’15 – Jun’25) | Nifty 500 TRI: 11% 10Y CAGR (Jun’15 – Jun’25) |

| Maximum Drawdown (%) | BTC: 83% (Jun’15 – Jun’25) | Nifty 500 TRI: 46% (Jun’15 – Jun’25) |

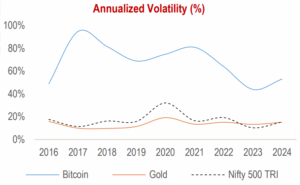

Risk-Return Analysis: Crypto vs. Equities vs. Gold

| Year | Bitcoin | Gold | NIFTY500 TRI |

|---|---|---|---|

| 2016 | 122% | 9% | 2% |

| 2017 | 1,291% | 13% | 47% |

| 2018 | -72% | -2% | -10% |

| 2019 | 89% | 18% | 7% |

| 2020 | 302% | 25% | 15% |

| 2021 | 57% | -4% | 28% |

| 2022 | -65% | 0% | -6% |

| 2023 | 154% | 13% | 26% |

| 2024 | 112% | 27% | 13% |

Source: Bloomberg, Investing. Note: Returns are in USD terms.

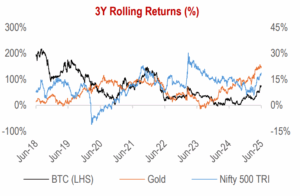

3 Years Rolling Returns (last 10 years) – “2,558” Observations:

| 3Y Rolling Returns (%) | BTC | Gold | Nifty500 TRI |

| Average Return (%) |

72% | 9% | 11% |

| Median Return (%) |

55% | 9% | 12% |

| % times Rolling Returns > 15% | 90% | 8% | 26% |

| % times Rolling Returns < 0% | 0% | 3% | 9% |

Source: Bloomberg, Investing. Note: Returns are in USD terms.

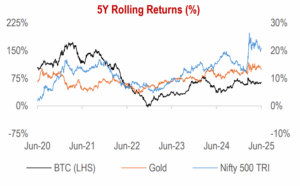

5 Years Rolling Average Returns (last 10 years) – “1,828” Observations:

| 5Y Rolling Returns (%) | BTC | Gold | Nifty500 TRI |

| Average Return (%) |

77% | 10% | 12% |

| Median Return (%) |

64% | 9% | 13% |

| % times Rolling Returns > 15% | 96% | 0% | 23% |

| % times Rolling Returns < 0% | 0% | 0% | 0% |

Source: Bloomberg, Investing. Note: Returns are in USD terms.

Source: Bloomberg, Investing. Note: Returns are in USD terms.

Bridging the After-Tax Gap: How much additional Bitcoin return is needed to match the post-tax return of equities?

As highlighted above, in India, the tax implications for Bitcoin (and other Virtual Digital Assets – VDAs) are significantly different and generally higher than those for equities. This section aims to illustrate how much additional return Bitcoin needs to generate to offset this higher tax impact.

Let’s assume a hypothetical scenario to demonstrate the difference in after-tax returns.

Assumptions:

The below table highlights the additional return Bitcoin would need, so that Bitcoin’s post-tax return = Equities post-tax return.

| Holding Period | Nifty500 TRI | Bitcoin (BTC) | Additional Return (%) |

| 1-year | 12% | 16.7% | 4.7% |

| 2-year | 12% | 16.4% | 4.4% |

| 3-year | 12% | 16.1% | 4.1% |

| 5-year | 12% | 15.6% | 3.6% |

| 7-year | 12% | 15.2% | 3.2% |

| 10-year | 12% | 14.7% | 2.7% |

Net-net, Bitcoin would need to generate approximately 3-5% additional return (across varied time periods) to offset the higher tax impact compared to equities.

Should Crypto Be in Your Portfolio?

Cryptocurrencies remain a speculative satellite asset, making it unsuitable for core allocations in ultra-high-net-worth portfolios under current conditions. Investors should exercise extreme caution and ensure robust due diligence until meaningful regulatory frameworks and investor protections are in place.

While crypto represents innovation, it also embodies significant risk. Investors are best served by aligning with asset classes that combine return potential, regulation, and robust risk management, such as equities, fixed income, and real estate.

However, high-risk investors still exploring crypto should only keep their actively traded assets in hot wallets (an internet-connected cryptocurrency wallet) for quick access and trading, while securely storing long-term holdings in cold wallets (stores cryptocurrency private keys offline, providing maximum security against online threats). Furthermore, high-risk investors should also be aware of the following critical factors: