While investors often turn to bonds for their stability and capital protection, it’s worth noting that bonds prices can move sharply in response to interest rate changes. The relationship between bond price and its yield is crucial to understand this dynamic.

% change in bond price = — (% change in yield) × (MD)

At 5% coupon rate and yield, MD of 10yr bond is ~8 and that of 30yr bond is ~15. This means that a 1% fall in yield leads to approx. 8% capital gain for 10yr bond and 15% capital gain for 30yr bond.

Let’s understand it better from a real time market scenario. During last 1 year, India’s 40yr G-sec yield has fallen by ~30 bps. This has resulted in an annual return of ~11% including accrual income and bond price gain (source: CCIL).

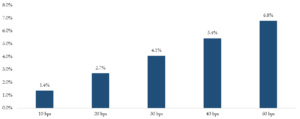

At current coupon/yield of 6.9%, the modified duration of 40yr G-sec is 13.6. Below is a scenario analysis of probable change in bond price in 40yr G-sec with fall in yield.

Probable bond price change in 40yr G-sec with fall in yields

Source: Internal calculations based on bond dynamics

Note: Changes in bond price shown above are absolute; accrual gain has not been considered in the returns shown above.

Disclaimer: Above calculations are shown for illustration purpose only. Actual changes in bond prices will be subject to market risks and volatility. Past performance is not an indication of future returns.

Key positives for long duration government bonds

Key risk