The Indian cement sector stands as a crucial pillar of the nation’s economic development, characterized by its significant scale and robust growth trajectory. As the world’s second-largest producer and consumer, India’s cement industry has demonstrated remarkable resilience and expansion, evidenced by a healthy ~7% CAGR in domestic demand between Fiscal 2020 and 2025. This growth is largely fueled by sustained government impetus on infrastructure development through flagship schemes like PM Gati Shakti, coupled with consistent demand from the housing sector, particularly in rural areas. Despite a relatively low per capita consumption compared to global averages, the sheer volume of demand and ongoing capacity expansions underscore the immense potential.

The production had remained almost stagnant over the previous six years, with the highest production of 4.4 billion metric tonne recorded in 2021.China is the world’s leading cement producer, accounting for almost half of the global output, most of which is for domestic use.

India is the second-largest producer, contributing 8-11% of the world’s cement. Over the period of 2018-2024, India recorded the highest compound annual growth rate (CAGR) of 5.04% among the top seven cement-producing countries, highlighting its rapid growth in the sector.

| Country | Production in CY18 (MT) | Share (%) | Production in CY24 (MT) | Share (%) | CAGR 2018-23 |

| China | 2,200 | 53.80% | 1900 | 47.50% | -2.41% |

| India | 335 | 8.20% | 450 | 11.25% | 5.04% |

| Vietnam | 90 | 2.20% | 110 | 2.75% | 3.40% |

| United States | 87 | 2.10% | 86 | 2.15% | -0.19% |

| Turkey | 73 | 1.80% | 82 | 2.05% | 1.96% |

| Iran | 58 | 1.40% | 72 | 1.80% | 3.67% |

| Brazil | 53 | 1.30% | 68 | 1.70% | 4.24% |

| Others | 1,193 | 29.30% | 1,332 | 33.30% | 1.85% |

| Total | 4,050 | 4,000 | -0.21% |

Source: JSW Cement RHP, CRISIL report.

India’s per capita cement consumption is notably low, ranging from 290-340 kg, which is significantly below the global average of 470-520 kg and far behind China’s 1,320-1,370 kg. Despite this low individual consumption rate, India remarkably stands as the second-largest cement consumer globally. This indicates substantial untapped growth potential for the Indian cement industry.

| Country | Per capita cement

(in KGs) |

| China | 1,320-1,370 |

| Turkey | 940-990 |

| Egypt | 400-450 |

| Japan | 350-400 |

| USA | 240-290 |

| India | 280-330 |

| Brazil | 290-340 |

| World | 470-520 |

Source: JSW Cement RHP, CRISIL report.

The Indian Cement Industry has seen significant investment, with an estimated ₹1300-1350 billion invested over the past five years (FY2021-2025E) in new capacity, expansions, and maintenance. Driven by a strong demand outlook and increasing competition, major players are planning even larger capital expenditures for the next five years.

Between Fiscal 2026 and 2030, an estimated 200-250 million tonnes per annum (MTPA) of new grinding capacity is expected to be added, requiring an investment of approximately ₹1600-1700 billion. This represents a healthy increase, equivalent to about 1.2 times the capital expenditure incurred over the previous five-year period.

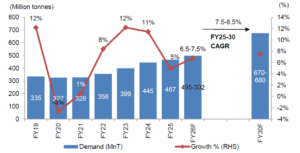

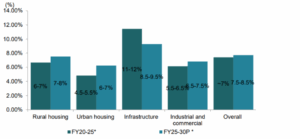

The Indian cement sector has demonstrated robust domestic demand growth, registering a healthy ~7% CAGR between Fiscal 2020 and 2025, even amidst the challenging backdrop of the pandemic. This resilience was predominantly driven by sustained government focus on infrastructure development and affordable housing initiatives. While Fiscals 2020 and 2021 saw subdued demand due to COVID-induced lockdowns, a significant rebound characterized Fiscals 2022 and 2023, with demand recovering by 8% and accelerating by ~12% respectively, underpinned by strong traction in rural housing and infrastructure projects. This growth trajectory continued into Fiscal 2024, recording an 11% YoY increase, boosted by pre-election spending and sustained infrastructure momentum. However, Fiscal 2025 witnessed a moderation in demand growth to ~5%, primarily attributable to the general elections and a temporary slowdown in government expenditure, underscoring the sensitivity of demand to the political and fiscal cycle.

Source: JSW Cement RHP, CRISIL report.

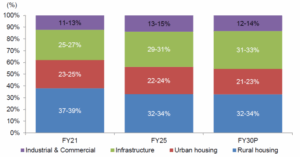

Over the past five years, the share of the housing and industrial/commercial segments in cement demand has declined, while the infrastructure sector’s share has risen significantly, jumping from 19-21% in Fiscal 2017 to 29-31% in Fiscal 2025, primarily due to a surge in government capital expenditure. The housing sector’s share declined initially due to weak economic conditions but saw a sharp post-pandemic rebound driven by factors like work-from-home trends and government schemes like PMAY.

Source: JSW Cement RHP, CRISIL report.

The Indian cement demand landscape for Fiscals 2026-2030 projects a nuanced shift in segmental contributions. While the housing segment is expected to remain the largest volume contributor. Concurrently, the infrastructure segment is poised for substantial expansion, with its share projected to rise to 31-33% by Fiscal 2030. This growth will be vigorously driven by the central government’s intensified focus on flagship schemes like PM Gati Shakti and robust investments across roads, railways, metros, airports, and irrigation projects.

Source: JSW Cement RHP, CRISIL report.