Investors often turn to bonds for their stability and capital protection, however, it’s worth noting that bonds prices can move sharply in response to interest rate changes. The relationship between bond price and its yield is crucial to understand this dynamic.

% change in bond price = — (% change in yield) × (MD)

At 5% coupon rate and yield, MD of 10yr bond is ~8 and that of 30yr bond is ~15. This means that a 1% fall in yield leads to approx. 8% capital gain for 10yr bond and 15% capital gain for 30yr bond.

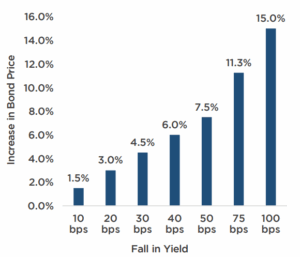

Considering the modified duration of 15 for 30yr bond , below is the scenario analysis of probable change in bond price in US 30yr G-sec with different levels of fall in yield.

Source: Internal calculations based on bond dynamics

Note: Changes in bond price shown above are absolute; accrual gain/coupon income has not been considered

Disclaimer: Above calculations are shown for illustration purpose only. Actual changes in bond prices will be subject to market risks and volatility. Past performance is not an indication of future returns.

Did You Know?

| Yield | MD | |

|---|---|---|

| US 30yr G-sec | 5% | 15 |

| India 30yr G-sec | 7% | 12 |

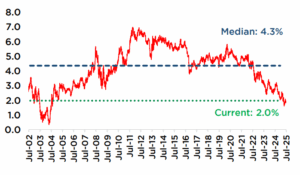

This structural difference means that US bonds are more responsive to shifts in interest rates, making them optimal for duration or interest rate strategies. Conversely, Indian bonds, with higher yields and relatively lower duration, are better suited to accrual-based approaches, where steady income is prioritized over interest rate strategies.

Source: Bloomberg

India 10yr vs. US 10yr G-sec Yield Spread (%)

Source: Bloomberg

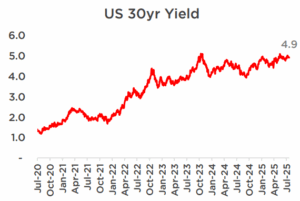

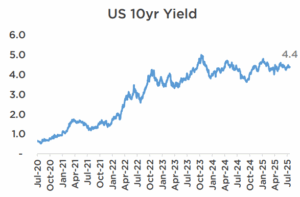

US Fed Rate Cuts – Fed has maintained its policy rate at 4.25-4.5% since Dec’24 and is widely expected to cut rates soon. As per CME FedWatch tool, market is factoring ~50 bps cut in Fed Funds rate in CY25. Cut in policy rates could lead to a fall in government bond yields.

Economic Slowdown or Recession – IMF had lowered US economic growth forecast to 1.8% in Apr’25 from their earlier estimate of 2.7% in Jan’25. In a slowing economy with a softening labor market and business sentiment, demand for risk-free assets like government bonds could increase.

US Inflation Easing Towards the Fed’s Target – Currently CPI inflation in US is 2.7% (Jun’25). While not yet at the 2% Fed’s target, steady disinflation could relieve pressure on the Fed to maintain tight monetary policy, a trend that could lower yields.

Potential for Geopolitical or Financial Shocks – New trade tariffs, global political events, or financial market volatility can provoke a “flight to safety,” causing investors rush into Treasuries, leading to fall in yields.

Moderation in Treasury Supply and Yield Curve Control Hints – While large-scale government borrowing has contributed to high yields, any signals of fiscal improvement or Fed intervention can shift demand in favor of Treasuries, capping or reducing yields.

Indian investors can open international brokerage accounts under the RBI’s Liberalized Remittance Scheme (LRS), which allows investments of up to $250,000 per individual per financial year in foreign assets. Through these accounts, investors can buy US Treasury ETFs. Purchasing direct bonds is also an option but it can be cumbersome as bonds could have high investment limits, low liquidity and involve higher transaction charges vs. ETFs. Some of the ETFs are listed below:

Note: Investors considering US Treasuries should exercise caution regarding taxation and regulatory requirements. Returns from overseas investments, including US Treasuries, are subject to Indian tax laws and US withholding tax on interest or dividends. Additionally, all foreign investments must comply with the RBI’s guidelines, which imposes annual caps and reporting obligations. Investors should stay updated on any changes in RBI rules, ensure proper tax filings, and verify that chosen investment platforms meet regulatory guidelines to avoid compliance issues and unforeseen tax liabilities.