Asset Class Return Quilt: Leadership Rotates, Allocation Endures

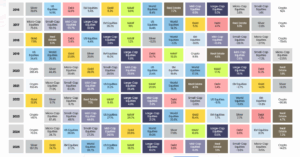

The 10-year return quilt highlights that asset-class leadership is highly cyclical, with no single asset class delivering consistent outperformance across different market cycles. Strategic asset allocation, not return chasing, remains the primary driver of long-term portfolio outcomes.

Over the last decade, leadership across asset classes has been highly cyclical. No single asset has delivered persistent outperformance across market cycles, with sharp rotations observed between equities, fixed income, real assets, and global exposures. Overall, the below table reinforces that long-term portfolio outcomes are driven by disciplined asset allocation and diversification, rather than tactical positioning or performance extrapolation.

Figure 1: The Decade of Diversification: 2016 – 2025 (INR Returns, CY Performance)

Source: Bloomberg, CRISIL, NHB, Ace MF, HDFC TRU.

Note:(1) Gold & Silver = MCX Spot Prices; (2) Debt = Crisil Composite Bond Index; (3) Crypto = Bloomberg Galaxy Crypto Index; (4) Real Estate = NHB Residex Index; (5) Large-Cap Equities = Nifty 100 TRI, Mid-Cap Equities = Nifty Midcap 150 TRI, Small-Cap Equities = Nifty Smallcap 250 TRI, Micro-Cap Equities = Nifty Micro-Cap 250 TRI, World Equities = MSCI ACWI Index, EM Equities = MSCI EM Index and US Equities = S&P 500 TR and (6) MAAF = Category Median Returns for Multi-Asset Mutual Funds (Direct Growth).

Key Takeaways:

- Asset Class Leadership. Market leadership is inherently cyclical. Sectors or asset classes that outperform in one economic environment, often underperform when macroeconomic conditions shift. History shows that “hot” streaks are temporary features of the market, not permanent bugs.

- The Mean Reversion Trap (Last Year’s Winner). Today’s top performer is frequently tomorrow’s laggard. Investors who “chase returns” by piling into the previous year’s best-performing asset often enter at peak valuations, leaving them vulnerable to the inevitable price correction as the market rotates toward undervalued sectors.

- The Absence of a “Universal” Asset. No single investment vehicle, whether it be Gold, Equities or Real Estate, dominates across all market cycles. Each asset class responds differently to inflation, deflation, growth, and recession; therefore, relying on one “hero” asset exposes a portfolio to idiosyncratic risk.

- Volatility Mitigation (Diversification for Consistency). Diversification acts as the only “free lunch” in investing. By spreading capital across non-correlated assets, you smooth out the highs and lows of the journey. While it may cap the absolute maximum return in a bull market, it significantly improves the reliability of long-term outcomes and prevents catastrophic drawdowns.

- Architecture Over Agility (Strategic vs. Tactical). Strategic Asset Allocation (the long-term blueprint) is a much more powerful driver of total returns than Tactical Timing (short-term bets). Success is determined by having a disciplined structure that aligns with an investor’s risk tolerance, rather than trying to perfectly time the “entry” or “exit” of a volatile market.