Real Estate Investment Trusts (REITs) offer a liquid and tax-efficient way to invest in commercial property without the burdens of physical ownership. They provide professional management, regulatory protection under SEBI, and attractive distribution yields (5-6% for listed REITs in India). While they offer low correlation to equity markets, investors should remain mindful of risks like market volatility and shifting interest rates.

Executive Summary:

- REITs are an important asset class for diversification of investments with low correlation to equity markets.

- They provide the benefits of investment in commercial real estate without the hassles of physically owning and managing a real estate asset and are a tax efficient structure.

- Listed REITs typically hold a diversified portfolio of real estate assets and have low concentration risks.

- REITs have much higher liquidity than physical real estate. Units of REITs can be purchased or sold on the stock exchanges. Entry and exit from REITs is easily achieved without the burden of large stamp duties.

- Physical real estate requires immense effort from an investor for finding tenants, managing operations, payment of relevant taxes, other compliances etc. These functions are carried out by professional management in REITs.

- REITs are governed by SEBI regulations which provide significant investor protection to unitholders.

- Listed REITs in India currently offer distribution yields of 4.9-6.0%. Total returns will be influenced by completion of under construction assets, increase in rentals and increase/decrease in valuation of underlying assets.

- REIT valuations may increase or decrease based on supply-demand dynamics and lease rentals earned by the underlying asset.

- Key risks in REITs include higher market volatility, interest rates, supply-demand dynamics.

Background:

India’s Real Estate Investment Trusts (REITs) are specialized vehicles:

- Own, operate, and manage income-generating assets like premium offices, malls, and hospitality properties.

- Revenue (derived primarily from lease rentals and operational income) is distributed back to unit holders as distribution.

- Units of REITs can be bought and sold on NSE/BSE (much like shares).

Much like a mutual fund for real estate, a REIT raises capital by issuing units to investors, which is then used to acquire real estate assets either directly or through Special Purpose Vehicles (SPVs).

History of REITs:

Since their inception in the U.S. in the 1960s, REITs have expanded to over 40 countries, with the global developed index now valued at over $1.8 trillion.

In India, the market is growing rapidly with five publicly traded entities: Embassy REIT, Mindspace REIT, Brookfield REIT, Nexus Select Trust, and Knowledge Realty Trust. The market cap of the five listed REITs has crossed INR1.6 tn. The potential for expansion is immense. JLL estimates that the REIT sector is poised for an additional INR 10.8 tn expansion opportunity across office and retail in just India’s top 7 cities by 2029. In addition, CBRE estimates that Small and Medium REITs (SM REITs) market potential is expected to exceed USD 75 bn, drawing from a pool of more than 500 mn sq. ft. of eligible office, retail and logistics space.

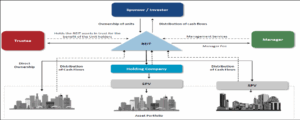

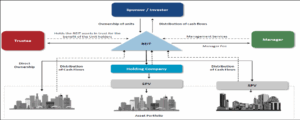

Structure of a REIT

Key stakeholders in a REIT:

- Unit holder/ Investor – Subscribes to REIT units and receives interest, dividend and debt repayment from REIT.

- Sponsor – Responsible for setting up the REIT and appointment of trustee.

- Sponsor(s) should collectively hold at least 25% of the units issued by REIT for at least 3 years and 10% after that.

- Sponsor(s) holdings above 25% have a lock-in period of one year from listing date.

- Trustee – Oversees the activities of REIT and is registered with SEBI as a debenture trustee.

- Manager – Manages assets of REIT and is responsible for day-to-day activities.

Source: Embassy REIT, HDFC Tru

REIT Regulations

REITs in India are governed by the SEBI (REIT) Regulations, 2014. The regulations build in some key features for investor protection:

- Minimum 80% of total value of assets to be invested in completed and income generating properties.

- Net Debt to not exceed 49% of total asset value.

- REITs must pay out at least 90% of their net distributable cash flows (NDCF).

- Sponsors cannot vote on any transactions involving the Sponsor group entities.

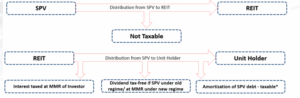

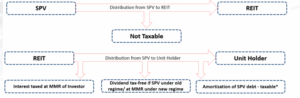

Taxation of REITs:

- REITs generally do not have to pay taxes on receipts from SPVs and thus avoids taxation at multiple levels.

- Distribution from REITs to unitholders are taxable in the hands of the unitholder.

- Generally, REITs distribute cash to the unitholder in three forms:

- Interest

- Dividend

- Repayment of capital

Distribution to the unitholders is in the same form and proportion in which REITs receive the money from SPVs. REITs therefore function as a pass through trust for the purpose of taxation.

Each investor should consult his tax advisor for detailed advice on taxation. The following is for illustration purpose only. The taxation for a resident Indian individual unit holder of a REIT is shown below:

Other key points:

- Distribution from SPV to Unit holder in the form of debt/capital repayment is adjusted against the cost of acquisition.

- TDS for resident individuals @10% for both interest and dividend (if taxable)

- Sale of units by unit holders on exchange:

- LTCG are taxed at 12.5% (plus cess and surcharge)

- STCG are taxed at 20% (plus cess and surcharge)

- Period for gains to be considered long term is 1 year or more.

Key Advantages of investment in REITs as an asset class:

- Diversified asset class: Returns from REITs typically are not correlated to broader equity markets. REITs therefore provide real asset diversification and would lower the volatility of the overall portfolio of the investor.

- Diversified basket of Real estate assets: REITs allow investors to gain exposure to a diversified basket of real estate assets without directly owning property. They typically invest in a portfolio of properties, reducing risk compared to owning a single property.

- Inflation Hedge: Real estate often appreciates over time and rents tend to rise with inflation, providing a natural hedge.

- Liquidity: Unlike physical real estate, REITs are traded on stock exchanges, making them easy to buy and sell like stocks without having to pay high stamp duties on every purchase.

- Regular Income: In India REITs are required by law to distribute a significant portion of their income (90% of Net distributable cash flows (NDCFs)) to unitholders. This makes them attractive for income-focused investors and provides a cushion to the total returns from the investment.

- Lower Capital Requirement- Investing in REITs requires much less capital than buying physical property, making real estate accessible to small investors.

- Professional Management: Properties in REITs are managed by experienced professionals, saving investors from operational hassles. Investors avoid the hassles associated with maintaining a physical property like finding tenants, maintaining property, paying local and central taxes etc.

Key Risks associated with REITs

- Oversupply risks: REIT valuations are impacted by supply-demand fluctuations in the underlying asset class. Rentals as well as occupancy levels in real estate could decline in case of excess supply relative to demand thereby negatively impacting REIT valuations.

- Market volatility: Unit prices of REITs have historically been more volatile than conditions in the underlying asset class. This volatility has historically been influenced by Covid, “work-from-home” trends, supply vs demand dynamics and changes in taxation related to REITs. Therefore, it is recommended that investors have a long-term horizon while investing in REITs.

- Sector Concentration Risk: Some REITs focus on specific sectors (e.g., retail, office, hospitality). If that sector faces downturns, the REIT’s performance can suffer.

- Interest rates: Any substantial increase in interest rates may adversely impact the valuation of REITs.

Factors impacting valuation of REITs

- Interest Rates: Lower rates reduce borrowing costs and make REITs more attractive compared to bonds.

- Economic Growth: Strong GDP growth boosts demand for commercial spaces (offices, retail, industrial).

- Inflation: Moderate inflation can benefit REITs as rents and property values rise.

- Property Sector Performance: Different sectors (retail, office, industrial, data centers) perform differently based on market trends.

- Management Quality: Efficient property management and strategic acquisitions improve returns.

- Leverage: REITs often use debt; prudent leverage can amplify returns, but excessive debt increases risk.

Valuation of REITs: A few important points regarding valuation of REITs

- Independent Valuation: As per SEBI regulations (for Indian REITs), an independent valuer must be appointed to conduct a valuation of the REIT’s assets every six months. This ensures transparency and accuracy in determining property values. The valuation report is disseminated to investors through exchanges/ REIT website. Typically, the valuer would use one or more methods for valuation including discounted cash flows (DCF), market replacement value etc. to arrive at the valuation.

- Net Asset Value (NAV): REITs declare their unit NAV every six-month based on the above independent valuation. The NAV is computed as the fair market value of all underlying properties minus liabilities.

- Market Price vs NAV: While NAV may give an indication of the value of the REIT’s assets, the market price of REIT units can differ from the NAV due to demand-supply projections, rental growth estimates, interest rates, and investor sentiment.

- Commonly used valuation terms:

- Price-to-NAV Ratio: Indicates whether the REIT is trading at a premium or discount to its NAV.

- Yield Analysis: Distribution yield is a key metric for income-focused investors.

- Capitalization rate: Capitalization rate (cap rate) is a real estate metric showing a property’s potential annual return, calculated by dividing its Net Operating Income (NOI) by its current Market Value (or purchase price) as a percentage (Cap Rate = NOI / Value x 100)

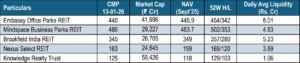

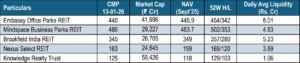

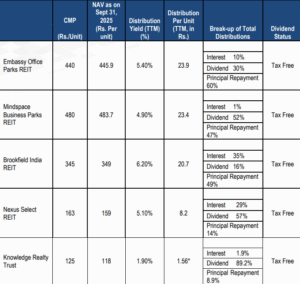

Key datapoints for Listed REITs in India

The unit price, market cap and ADTO of listed REITs is summarized below:

(Source: Company Website, BSE, screener.in)

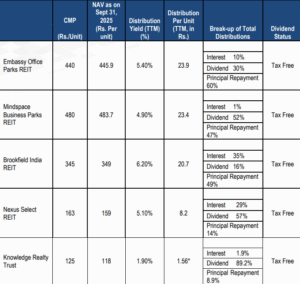

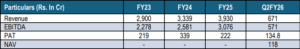

Select operating level data points of key REITs is summarized below:

*For Sept quarter only as Knowledge Realty got listed in August 2025

(Source: Company Website, BSE, screener.in)

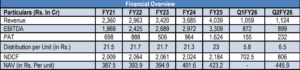

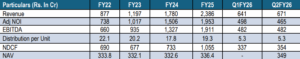

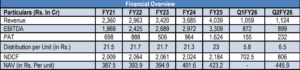

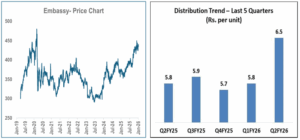

Embassy Office Parks REIT

- Embassy Office Parks REIT (Embassy REIT) is India’s first publicly listed REIT.

- It is sponsored by Blackstone Sponsor Groups / Embassy Sponsor Entity

- Sponsor and Sponsor Group held 8%, Institutional investors held 74% and non-Institutional investors held 18% stake in the REIT as of Sept 30, 2025

- Embassy REIT owns and operates a 51 million square feet (“msf”) portfolio of ten infrastructure-like office parks and four city‑center office buildings.

- Of the total leasable area, 78% was completed area, 12% was under construction and 10% was proposed development area as of Sept 30, 2025 . 75% of its total leasable is in Bengaluru, 9% is in Mumbai, 7% in Pune and 6% in Noida

- Embassy REIT’s portfolio comprised of total leasable area of 51 msf, of which 40.4 msf was completed area and had an occupancy of 91% as of Sept 30, 2025

- The Weighted Average Lease Expiry (WALE) of the portfolio was of 8.5 years; re-leasing spread stood at 1.0% and it had an in-place rent (psf) of Rs. 92.0 as of Sept 30, 2025. The MTM opportunity was 10% as of Sept 30, 2025

- Global capability centres (GCCs) accounted for 64% of annual leasing.

- Management guidance of DPU of Rs. 24.5 to 26.0 per unit for FY26

(Source: Company Website, BSE, screener.in)

(Source: Company Website, BSE, screener.in)

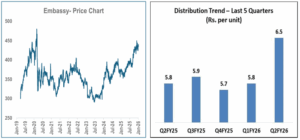

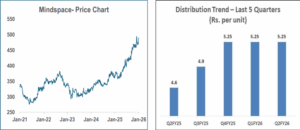

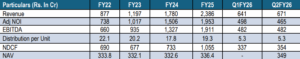

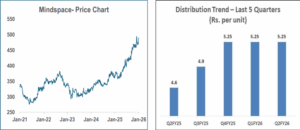

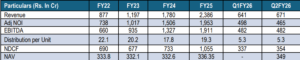

Mindspace Business Parks REIT

- Mindspace Business Parks REIT (Mindspace) is set up and sponsored by K Raheja Group

- The REIT owns IT and office spaces, located in established micro-markets with proximity and/or connectivity to major business, social, and transportation infrastructure.

- Sponsor and Sponsor Group held 64.5%, Institutional investors held 26% and non-Institutional investors held 9.5% stake in the REIT as of Sept 30, 2025

- Mindspace’s portfolio comprises of 6 integrated business parks and 5 independent offices.

- Total leasable area comprises of 38.2 msf, of which 31 msf is completed area, 3.7 msf is under-construction and 3.5 msf is future development area as of Sept 30, 2025

- Of the total leasable area, 38.3% is in Mumbai region, 14.4% in Pune, 44.3% in Hyderabad and 3.0% in Chennai

- The Weighted Average Lease Expiry (WALE) of the portfolio was of 7.4 years, committed occupancy stood at 92.1% on completed area and it had an in-place rent (psf) of Rs. 73.5 as of Sept 30, 2025

- The MTM opportunity was 18.7% as of Sept 30, 2025

- Mindspace’s portfolio is well diversified with more than 200 tenants and no single tenant contributing more than 5.0% of its Gross Contracted Rentals.

(Source: Company Website, BSE, screener.in)

(Source: Company Website, BSE, screener.in)

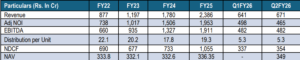

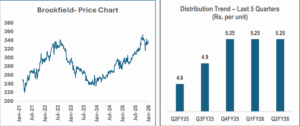

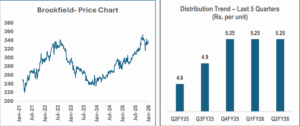

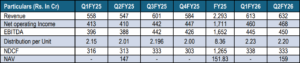

Brookfield India REIT

- The Brookfield India Real Estate Trust (Brookfield REIT) is India’s only institutionally managed public commercial real estate vehicle.

- It is sponsored by an affiliate of Brookfield Asset Management

- Sponsor and Sponsor Group held 43.9%, Institutional investors held 38.7% and non-Institutional investors held 17.4% stake in the REIT as of Sept 30, 2025

- Brookfield REIT’s portfolio comprises 4 grade-A commercial assets located in four major cities – Mumbai, Gurgaon, Noida and Kolkata.

- Total completed leasable area is of 24.5 msf, 0.6 msf is under construction area and 4.0 msf is future development area as of Sept 30, 2025

- Of the total leasable area, 28.0% is in Mumbai region, 63% is in NCR region and 8% is in Kolkata.

- The Weighted Average Lease Expiry (WALE) of the portfolio was of 7.0 years, committed occupancy stood at 88.0% and it had an in-place rent (psf) of Rs. 97.0 as of Sept 31, 2025

- Portfolio has a well staggered lease expiry profile with only 35% of the contracted rentals due for expiry till FY2029.

- The REIT has Strong inorganic growth pipeline through Identified Assets and ROFO Properties within the Brookfield Group

(Source: Company Website, BSE, screener.in)

(Source: Company Website, BSE, screener.in)

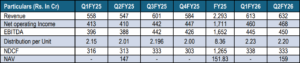

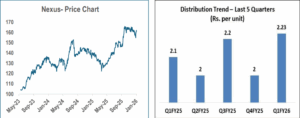

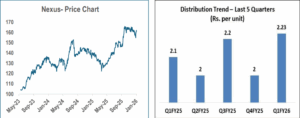

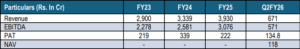

Nexus Select Trust

- Nexus Select Trust REIT (Nexus REIT) is the owner of India’s leading consumption platform of high-quality mall assets that serve as essential consumption infrastructure for India’s growing middle class (by completed area).

- It is sponsored by Wynford Investments Limited , a portfolio company of Blackstone Inc.

- Sponsor and Sponsor Group held 47.2%, Mutual funds held 15.9%, Insurance companies held 5.8%, Foreign Portfolio Investors held 29.9% and others held 31.1%.

- Nexus REIT Portfolio comprises 18 best-in-class ‘Grade A’ urban consumption centers with a total Leasable Area of 10.6 msf, two complementary hotel assets (450 keys) and three office assets (1.3 msf) as of Sept 30, 2025

- Nexus REIT’s Portfolio had a tenant base of 1,000+ domestic and international brands with ~3,000 stores as of Sept 30, 2025.

- While Nexus REIT Portfolio is highly stabilized with leased occupancy of 96.9% and 4.7-year WALE as of Sept 30, 2025, its Portfolio enjoys strong embedded growth prospects.

- Nexus REIT is well-positioned for strong organic growth through a combination of contractual rent escalations, increased tenant sales leading to higher Turnover Rentals and re-leasing at higher market rents.

(Source: Company Website, BSE, screener.in)

(Source: Company Website, BSE, screener.in)

Knowledge Realty Trust

- Knowledge Realty Trust (KRT), formed in October 2024 and backed by Blackstone and Sattva

- Knowledge Realty Trust (KRT) got listed on 18th August 2025.

- Its portfolio comprises 29 Grade A office assets across 6 city-center offices and 23 business parks/centers, totaling 46 msf as of Sept’25, with 37.1 msf of completed area, 1.2 msf of under construction area and 8.0 msf of future development area as of 30th Sept 2025.

- Portfolio assets are spread across 6 cities, namely Hyderabad, Mumbai, Bengaluru, Chennai, Gurugram and GIFT City, Ahmedabad. Approximately 96% of the portfolio assets are located in Bengaluru, Mumbai and Hyderabad.

- The portfolio includes marquee properties like One BKC, Sattva Knowledge City, and Cessna Business Park, along with 4 ROFO assets offering 7 msf of development potential.

- 91.4% committed occupancy and 8.4 years WALE as on 30th Sept 2025.

(Source: Company Website, BSE, screener.in)