A Forgettable year for Indian Markets vs. Global Peers

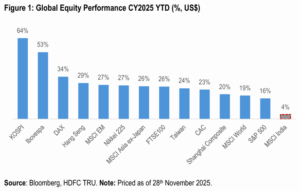

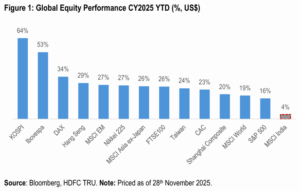

The year 2025 witnessed a stark divergence across global equity markets. While major developed economies and select emerging markets experienced a strong rally, fueled by easing inflationary pressures, robust corporate earnings (especially in AI/tech), and monetary policy shifts, Indian equities found themselves on a slightly different trajectory. Following years of outperformance, the MSCI India delivered only a modest return (~4% YTD, US$), significantly lagging the 20%+ gains seen across key Asian/EM peers and developed markets. This underperformance stemmed from three primary headwinds: i) persistently elevated equity valuations, ii) deceleration in corporate earnings growth, and iii) substantial exodus of Foreign Portfolio Investor (FPI) capital.

The Scorecard: India vs. Global Peers

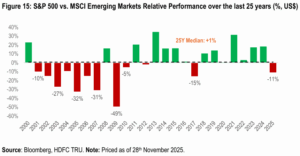

- The year 2025 marked a crucial pivot for global equity performance. As economic concerns began to subside and the “higher for longer” interest rate narrative softened, markets in the US, Europe, and parts of Asia surged. The S&P 500, driven by a concentrated rally in mega-cap tech, recorded 16% YTD Return. Similarly, the DAX and Nikkei 225 posted impressive gains of 34% and 27% YTD (US$), respectively.

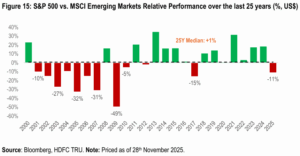

- Even within Emerging Markets, benchmarks like the Kospi (South Korea), Ibovespa (Brazil) and Hang Seng (Hong Kong) saw meaningful rebounds. Infact, the overall MSCI Emerging Markets Index (MSCI EM), outperformed the Indian equity indices (both the Nifty50 and MSCI India) by >20%.

- India, which had been a darling for several preceding years, struggled to keep pace. The MSCI India, in USD terms, generated a paltry 4% YTD return, positioning it among the worst-performing major global equity markets for the year.

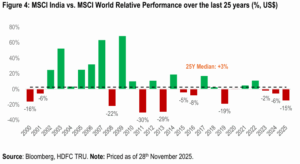

Indian equities underperformed the broader Emerging markets and Asian peers by >20% this year

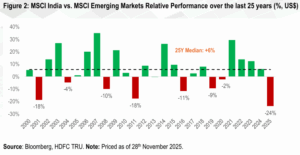

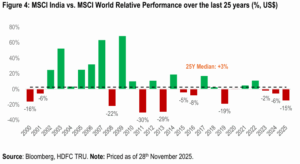

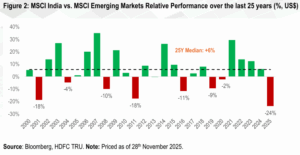

- The historical performance of Indian equities (MSCI India) relative to the broader Emerging Markets (MSCI EM) index has been characterized by outperformance over the long term, despite periods of volatility and recent consolidation.

- Over the past 5years, the MSCI India index has delivered an annualized return significantly higher than the MSCI EM index, at ~13% for India compared to roughly 5.5% for the MSCI EM.

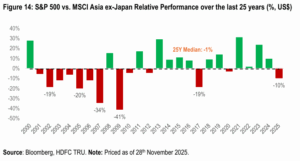

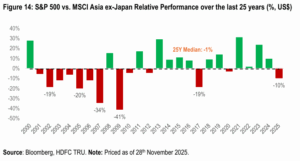

- However, this outperformance narrowed significantly in CY2025, driven by an AI-led global rally and capital flowing to cheaper markets such as China, resulting in India underperforming the broader global indices.

- We also note that, the relative underperformance of the Indian markets vs. the MSCI EM and the MSCI Asia (ex-Japan) Index in CY2025 (till end-Nov), is at highest level since 2000. The primary drivers of this significant underperformance were elevated starting valuations and a cyclical slowdown in both economic growth and corporate earnings.

Deconstructing the Underperformance: The Three Main Drags

India’s subdued performance in CY2025 was a culmination of three powerful, interconnected headwinds:

A. Valuation Headwinds

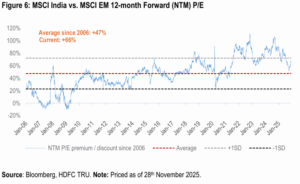

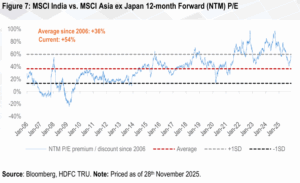

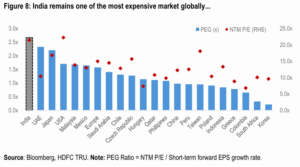

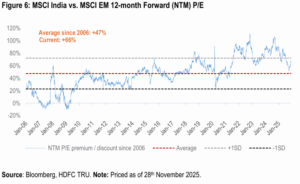

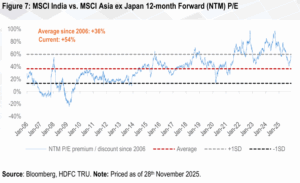

- For several years, Indian equities have traded at a significant premium to both their historical averages and emerging market peers. This trend continued into CY2025, with the MSCI India’s forward P/E ratio consistently hovering around 20-22x, compared to the MSCI Emerging Market average of 12-14x. This premium was largely justified by strong structural growth narratives, robust domestic consumption, and policy reforms.

- However, in an environment where global liquidity began to tighten and opportunities emerged in undervalued markets (e.g., China/Hong Kong’s rebound), or in sectors with more certain growth drivers (e.g., AI-driven tech), India’s high valuations became a significant barrier.

- Investors, seeking better risk-adjusted returns, found the entry points in Indian equities less appealing, leading to a rotation out of the market. The high valuation acted as a “drag,” meaning even positive news struggled to propel prices higher, while any negative news led to disproportionate selling.

B. Corporate Earnings Slowdown

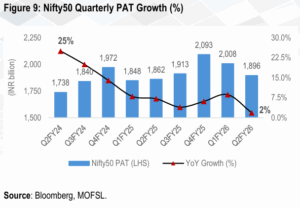

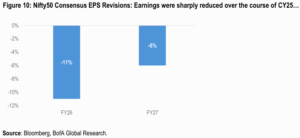

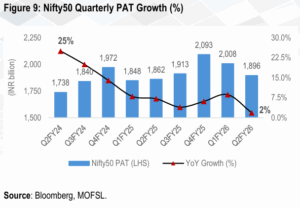

- The second critical factor was a noticeable deceleration in corporate earnings growth. After a period of robust recovery post-pandemic (FY21-24 PAT CAGR of ~26%), the pace of Profit After Tax (PAT) growth for Nifty50 companies slowed considerably in FY25 / H1FY26 to 5% y/y.

- Slower earnings growth was majorly driven by sluggish demand environment (both domestic and global), reduced discretionary spending, weak credit growth and tepid global IT demand.

C. Foreign Portfolio Investor (FPI) Retreat

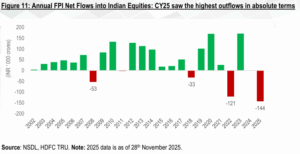

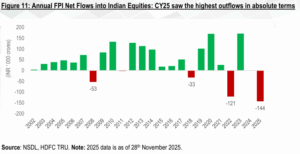

- A significant driver of India’s underperformance was the consistent and substantial selling by FPIs. CY2025 witnessed cumulative FPI outflows totaling approximately $18bn. This marked the highest calendar year outflow since 2002 and represented a stark reversal from the previous year’s trends.

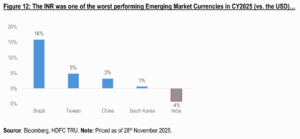

- The FPI exodus was multifaceted. Globally, higher-for-longer interest rates in the US, combined with a weak INR, made dollar-denominated assets more attractive, drawing capital away from riskier emerging markets.

- Domestically, India’s high valuations, coupled with the earnings slowdown, provided little incentive for FPIs to maintain their positions, particularly when alternative markets offered more compelling value or clearer growth narratives. The consistent selling created a liquidity drag, absorbing any buying interest from domestic investors and limiting upside potential.

Global Capital Rotation: A Shift Beyond US Dominance

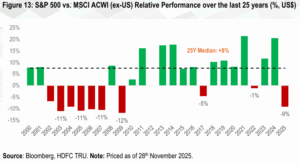

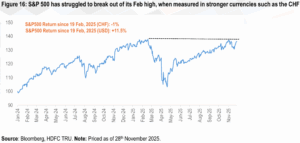

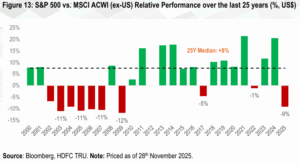

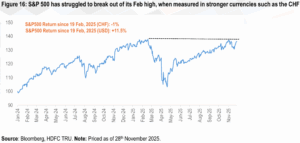

- While it’s clear that India has underperformed against all major global indices this year, we note that the narrative of regional underperformance in 2025 extends beyond just India; even the highly dominant US market registered major underperformance relative to the broader global markets.

- After years of exceptional returns driven by a narrow cohort of mega-cap technology stocks, the S&P 500’s YTD return was materially lower than most of the major international markets, such as Japan, China, the UK, Germany, etc.

- This rotation was catalysed by two main factors: i) attractive deep-value opportunities in non-US markets and ii) a cyclical depreciation of the USD, which boosted the returns of international investments for USD-based investors.

- Therefore, both the US and India, being two of the highest-valued major markets, saw capital shift toward cheaper regions.

Our Take:

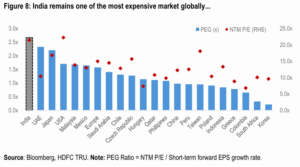

- Expensive Starting Valuations: India entered 2025 as one of the most expensive large equity markets globally. Valuations were well above long-term averages, leaving no room for disappointment. Other markets benefited from rerating from lower bases, while India faced valuation compression.

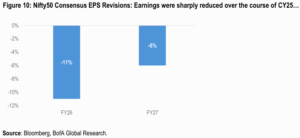

- Corporate Earnings below Expectations: Corporate earnings were respectable, but not strong enough for premium valuations. Growth was narrow and consensus earnings expectations were revised down, driving steady de-rating.

- Sector Mix Not Aligned With Global 2025 Winners: Global equity winners were AI, chips, tech platforms, and select commodities. India is more weighted to financials, domestic consumption, and IT services, which underperformed. IT struggled amid cautious global tech spending and consumption remained uneven.

- Style/Factor Rotation Hurt India: 2025 saw a shift toward value and cyclicals. India is a quality/growth-heavy market and lagged as investors rotated away from high premiums. Markets with deep cyclicals and value stocks rallied more strongly.

- Flow Dynamics Turned Unfavourable: FPIs reduced allocations to India, rotating toward cheaper EMs and US tech. Domestic inflows stayed positive but showed fatigue, especially in small/mid-caps.

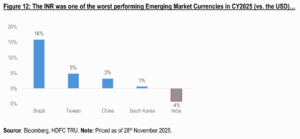

- Macro Variables Didn’t Provide an Offset: Real rates remained relatively high (India’s current 10-year real yield at >5% vs. China at 1.8% and the US at 1.5%), increasing equity risk premiums. INR remained weak, offering no currency-led boost to foreign returns. Meanwhile, other markets saw positive FX translation or strong currency rebounds.

- Sharp De-Rating in Mid & Small Caps: After multi-year outperformance, valuations in mid/small caps became stretched. Any negative catalyst (earnings miss, liquidity tightening, regulatory caution) led to steep corrections. Given their weight in portfolios, this dragged India’s aggregate performance.

Net-net, fundamentals remained solid, but not strong enough to justify peak valuations. Incremental disappointments created a derating cycle across sectors and market caps. India’s long-term structural story is intact, but CY2025 highlighted that valuations eventually catches up.