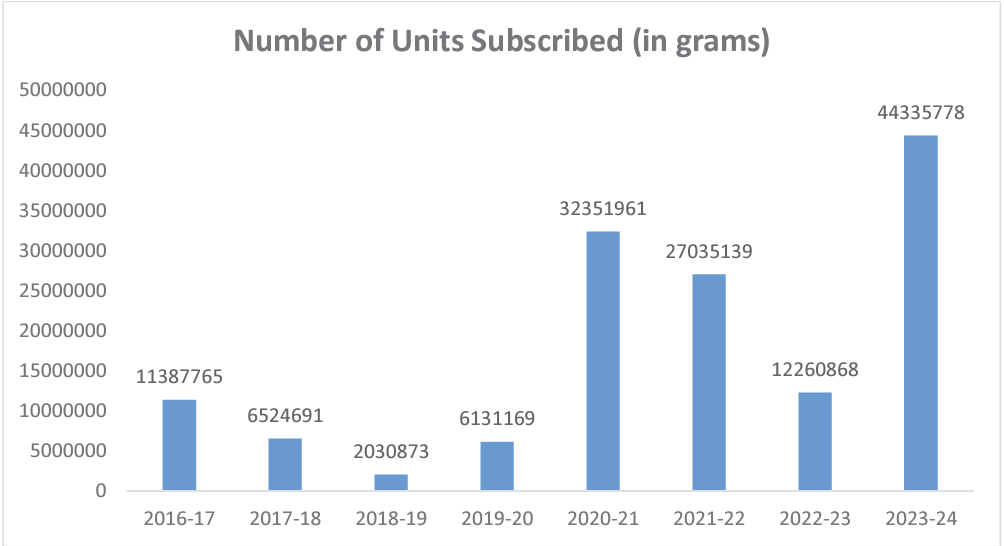

Indians always have a special place for gold in their hearts and portfolios. Sovereign Gold Bonds or SGBs have recently become a popular choice. The surge in subscriptions in 2023-24 tripling compared to the previous year speaks volumes.

Source: India Gold Policy Centre (IIM-A)

Grasping the tax implications of these bonds is crucial. Interest earnings, capital gains upon redemption, and transfers each have distinct tax treatments. Misunderstanding these can affect your profits.

This blog delves into these specifics. Explore the Sovereign Gold Bond tax benefits and make informed decisions.

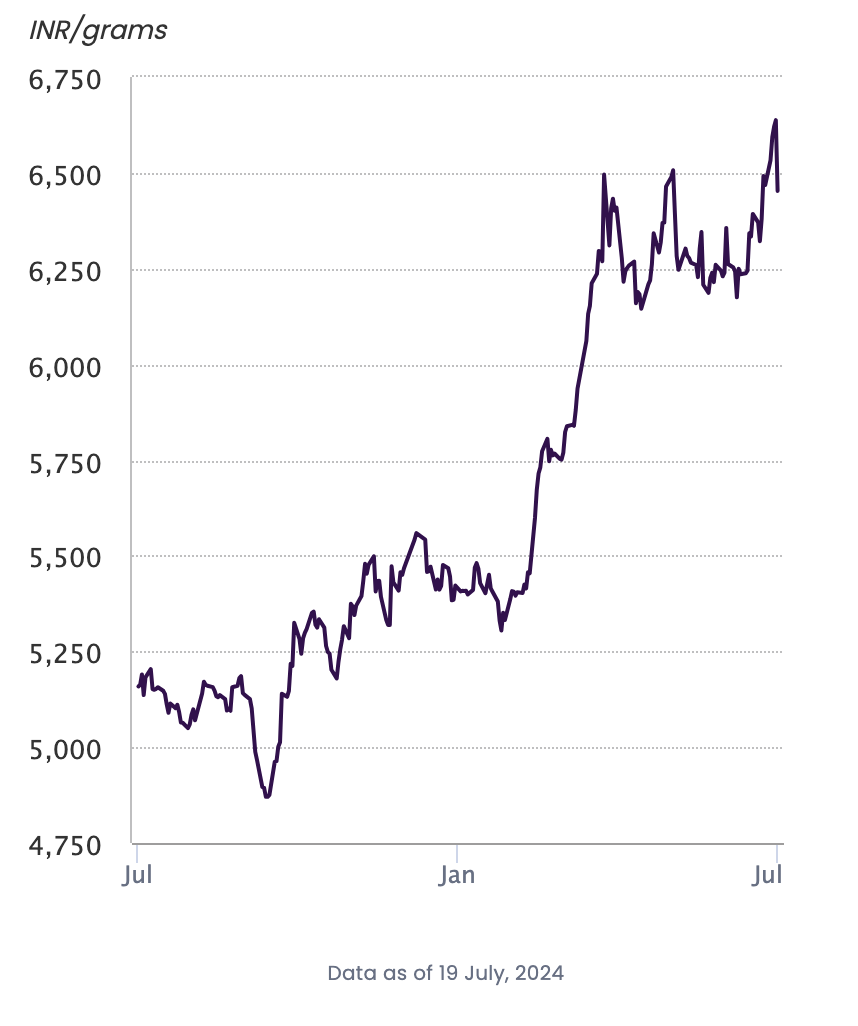

SGBs are financial instruments introduced by the Indian government to offer an alternative to purchasing physical gold. Issued by the apex bank Reserve Bank of India or RBI, these instruments are measured in grams of gold, providing a more secure and economical option for investors. Recently, with gold prices climbing to ₹6452 per gram on July 19, 2024, SGBs have become increasingly appealing.

Source: World Gold Council (19-July-2024)

SGBs are released in tranches. Take for example the 2023-24 Series IV tranche: you would have subscribed to these bonds between February 12-16, with the issuance date set for February 21, 2024.

The pricing is pegged to a simple average of the closing price of the purest form or 999 purity gold as noted by the IBJA–India Bullion and Jewellers Association Limited, calculated over the last three working days before the subscription.

These instruments are available for purchase through approved institutions such as post offices, banks, and stock exchanges. Payment methods are varied, and the bonds can be held in demat form or as certificates. Denominations start from just one gram. The redemption term is eight years, but they give flexibility by allowing an early exit option after five years on predetermined days.

SGBs offer several advantages:

Is there a Sovereign Gold Bond tax exemption under Section 80C? No. SGBs are not eligible. However, the profit from the appreciation in gold value at maturity is exempt from capital gains tax.

Suppose you purchased SGBs in early 2016 at ₹2600 per gram. By the time they matured in early 2024, the value increased to ₹6271 per gram. The profit of ₹3671 per gram is completely tax-free at maturity.

However, this tax exemption applies only if the bonds are held for the entire eight-year period. If you choose to redeem them early, the profit will be subject to capital gains tax as per applicable rates.

Yet, an early withdrawal option exists after five years. For individuals, capital gains from such early redemption are tax-exempt. This Sovereign Gold Bond tax exemption is facilitated by Section 47(viic) of the Income Tax Act-1961, which excludes these redemptions from being classified as 'transfers.'

To redeem SGBs early, you must submit them to the RBI before the next interest payment date. Timing is crucial. Inform your bank or distribution agency 30 days beforehand. This makes sure the process starts smoothly.

The earnings from SGB are taxable. Paid bi-annually, these earnings must be added to your total income for the financial year and taxed based on your applicable slab.

For example, if you're in the 20% bracket, the interest from SGBs will also be taxed at that rate. Report this under ‘Income from Other Sources’ in your tax return.

SGB earnings do not have Tax Deducted at Source (TDS). Declaring these revenues is necessary nonetheless to ensure effective tax calculations and adherence to tax laws. Legal complexities can be avoided with proper documentation.

SGBs sold on the stock exchange before maturity involve specific tax considerations based on the holding period.

If SGBs are sold within a year, the profit qualifies as short-term capital gains (STCG). Such earnings will be reflected in your income and qualify for taxation based on the tax bracket that applies to you.

Selling SGBs after holding them for over a year leads to long-term capital gains (LTCG). SGB LTCG is subject to a flat 12.5% rate with effect from July 23, 2024 (exemption limit - ₹1.25 lakh). Before the Union Budget 2024, it was 20% with indexation (purchase amount adjusted for inflation) and 10% without indexation.

Consider an example: Suppose you bought 100 units of the SGB 2016 Series II at ₹2.8 lakh in 2017. By August 2024, if you sell at ₹7.8 lakh, the profit from this sale is considered LTCG. A 12.5% tax rate results in a tax liability of ₹62.5k.

| Details | Without indexation |

|---|---|

| Purchase year | 2017 |

| Sale year | 2024 |

| Purchase price | ₹2.9 lakh |

| Sale price | ₹7.8 lakh |

| Profit | ₹5,00,000 |

| Tax Rate | 12.5% |

| Tax liability | ₹62,500 |

Understanding the tax rules for Sovereign Gold Bonds can enhance your financial planning. While interest earnings are subject to tax, profits at maturity are exempt. Early redemptions and stock exchange sales have distinct tax treatments. Stay informed and make strategic choices to maximize your SGB investment benefits.