As the investment landscape becomes increasingly complex, family offices and ultra-high-net-worth individuals (UHNIs) are shifting their focus toward index funds and smart beta strategies. This transition reflects a broader trend in asset management, where cost efficiency, performance, and risk management take centre stage.

Active Management Under Pressure

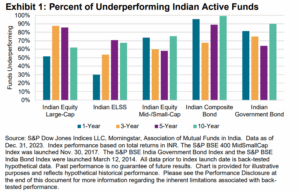

One of the primary drivers behind this shift is cost efficiency . Active fund management often incurs hefty fees that can erode returns over time. A significant number of actively managed funds have struggled to keep pace with their benchmarks. For instance, over half of Indian equity large-cap funds have underperformed the S&P BSE 100, with 52% lagging behind. Globally, around 66% of actively managed funds fail to outperform their respective indices over the long term source: SPIVA Report .

The latest SPIVA report for India reveals that over a five-year horizon, nearly 85% of active equity funds underperformed their benchmarks , emphasizing the challenges faced by active managers in consistently delivering superior returns.

Smart Beta as a Solution

In contrast, smart beta funds blend the best of both worlds—active and passive management—at a fraction of the cost. They allow family offices to pursue alpha generation without breaking the bank, making them an attractive option in today’s market.

The Power of Factor-Based Strategies

Smart beta strategies focus on specific factors such as value, momentum, low volatility, and quality. These strategies enable family offices to enhance their portfolios’ performance without taking on excessive risk. For example, the NIFTY200 Momentum 30 index and the Nifty 100 Alpha Low vol Index have demonstrated higher returns compared to traditional indices like the NIFTY 50 while maintaining a stable risk profile. These strategies are particularly appealing in volatile markets where traditional active management may falter.

| Index | 3 year | 1 year | ||||

| Rolling

Return |

Volatility

(Std Dev) |

Sharpe Ratio

(Rf=6.745%) |

Rolling

Return |

Volatility

(Std Dev) |

Sharpe Ratio (Rf=6.656%) | |

| NIFTY 50 | 11.17% | 6.76% | 0.65 | 15.22% | 23.29% | 0.37 |

| NIFTY NEXT 50 | 13.11% | 9.38% | 0.68 | 19.30% | 34.14% | 0.37 |

| NIFTY 100 | 11.43% | 6.84% | 0.68 | 15.68% | 24.37% | 0.37 |

| NIFTY200

MOMENTUM 30 |

17.18% | 9.05% | 1.15 | 22.92% | 28.56% | 0.57 |

| NIFTY100 LOW VOLATILITY 30 | 13.93% | 5.97% | 1.20 | 17.48% | 22.24% | 0.49 |

| NIFTY ALPHA 50 | 17.04% | 14.00% | 0.73 | 25.44% | 38.49% | 0.49 |

| NIFTY ALPHA LOW-VOLATILITY 30 | 15.96% | 7.99% | 1.15 | 20.18% | 23.40% | 0.58 |

Rolling performance as of October 14, 2024. April 01, 2005 to October 14, 2024. Risk Free Rate Rf – 3 year and 1 year govt bond yield as on October 14, 2024

A Safety Net for Large Portfolios

Smart beta funds also offer a level of diversification that is hard to achieve through active management alone. By adhering to predefined rules for stock selection and weighting, these funds help mitigate concentration risk often associated with market-cap-weighted indices. In India, smart beta index funds assets for 51 such ETFs and Funds have surged from less than ₹1,000 crores in 2021 to nearly ₹31,000 crores as of October 2024. Source:AMCs AUM Data/AceMF

A Strategic Hybrid Approach

While many family offices still allocate substantial portions of their assets to actively managed funds, they increasingly see smart beta as a complementary strategy rather than a replacement. Santosh Singh from Mirae Asset Investment Managers explains that “smart beta can target specific risk-return profiles that traditional active or passive funds may miss” source: Financial Express .

This hybrid approach offers:

The Shift Towards Factor-Based Investing

The global landscape for smart beta investing is equally compelling. According to the SPIVA Global report, about 84% of actively managed global equity funds failed to beat their benchmarks in 2023 source: SPIVA Global Report . This trend underscores ongoing challenges faced by active managers across various regions.

In the U.S., smart beta ETFs have gained significant traction; new launches accounted for roughly a third of all ETFs introduced in recent years source: ETF Trends . The popularity is driven by a desire for better portfolio risk management and diversification along factor dimensions. By integrating index funds and smart beta strategies into their portfolios, family offices can optimize asset allocation while maintaining the flexibility needed to adapt to changing market conditions. Embracing these innovative investment vehicles may just be the key to unlocking greater financial success in today’s dynamic market environment.

Sources

Economic Times: Over 52% of Active Equity Funds Underperform Benchmark in 2022

SPIVA Report: SPIVA Global Year-End 2023

Moneycontrol: Smart Beta Strategies Can Outperform Traditional Indices – Motilal Oswal Asset Management

Economic Times: From Active to Passive: Why Factor-Based Funds Are Winning Over Indian Investors

Business Standard: Smart Beta Funds See Assets Surge to Rs 35,000 Crore in India

Morningstar: The Smart Beta Report 2022

Financial Express: Smart Beta Funds Can Target Specific Risk Return Profiles – Mirae Assets Santosh Singh

ETF Trends: Smart Beta ETFs Gain Significant Traction