As the world becomes increasingly interconnected, global investments have gained significant traction among Indian investors. No longer confined to domestic markets, Indian investors are increasingly looking beyond the country’s borders for diversification, wealth creation, and exposure to opportunities that exist in international markets.

The introduction of the Liberalized Remittance Scheme (LRS) by the Reserve Bank of India (RBI) in 2004 was a turning point in India’s financial landscape. Under this scheme, Indian residents can remit up to $250,000 per financial year for various purposes, including investments, studies, travel, real estate, etc.

When introduced, the LRS limit was much lower at $25,000 per financial year, which has increased over the years to $250,000. For investors, this has opened doors to participate in international markets, whether by investing in iconic companies like Apple, Google, and Tesla, or by accessing other asset classes that may not be easily available in the domestic market.

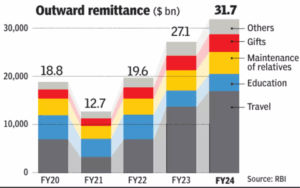

Indian remittances overseas have increased steadily over the years. Indians spent a record $31.7 bn overseas under LRS in FY 24, up by 17% YoY. This surge occurred despite the imposition of tax collection at source (TCS). Travel makes up for more than half of the outgo.

Diversification: Diversification is one of the key benefits of investing globally. Spreading investments across different geographies and asset classes, investors can reduce the risks associated with a single market, whether due to economic downturns, political instability, or market volatility.

Protection from currency deprivation: Investing globally helps Indian investors to diversify their currency exposure by holding assets in stronger currencies like the US dollar, Euro, etc. Indian investors can hedge against the depreciation of the Indian rupee and benefit from potential currency appreciation.

Allocation to leading global companies: Investing in leading global companies allows investors to tap into the growth and innovation of some of the world’s most influential and high-performing businesses. Companies like Apple, Amazon, Microsoft, and Tesla, which are industry leaders in their respective segments, offer strong growth potential.

International goal: Overseas investments help investors meet their international goals, like sending children abroad for education, etc.

Mutual funds have been the go-to choice for Indian investors seeking exposure to global markets. Indian AMCs offer international mutual funds and ETFs that allow investors to diversify overseas conveniently and also avoid the complexities of direct stock selection or navigating foreign exchanges.

Mutual funds offer ease of access, are professionally managed, and have lower transaction costs due to economies of scale.

Technological advancement and the advent of online trading platforms have democratized global investing. Fintech platforms now allow Indian investors to invest in international stocks with relative ease. Platforms like Vested, Stockal, and INDmoney have made it possible for Indian investors to invest in US equities with as little as a few thousand rupees. These platforms offer seamless integration with LRS, making global investments accessible to a larger audience.

In recent times, Indian investors have faced challenges with mutual funds as a vehicle for overseas investments. The Securities and Exchange Board of India (SEBI) placed restrictions on mutual fund houses in India with respect to international investments, capping the overall overseas investment limits at USD 7 billion. This cap, initially set years ago, was rapidly hit due to the surge in demand for global investments, especially during the pandemic when global markets, particularly the US, became an attractive destination for Indian investors.

Conclusion:

Global investing offers Indian investors significant benefits, including diversification, risk mitigation, and access to international innovation. However, regulatory challenges such as restrictions on mutual fund flows pose hurdles that need to be addressed to fully capitalize on these opportunities. With the right balance between global exposure and domestic investments, Indian investors can build robust portfolios capable of weathering both local and global economic storms.